Owning a turkey farm comes with many potential risks, from stolen revenue to property damage and more. As a responsible business owner, you’ve got to anticipate all these potential disasters from the start. That means getting set up with the right turkey farm insurance right away.

Fortunately a Tennessee independent insurance agent can help you address the needs of your turkey farm and help you find the correct insurance for your specific business. But before jumping too far ahead, let’s take a closer look at this critical coverage.

What Is Turkey Farm Insurance?

Essentially a special form of Tennessee farm insurance, turkey farm insurance is designed to meet the needs of turkey farm owners. It includes the basics of a Tennessee business insurance policy, with protection for your property and revenue, and more specific coverages tailored to the needs of your turkey farm. A Tennessee independent insurance agent can help you find the right coverage for your unique turkey farm.

What Does Turkey Farm Insurance Cover in Tennessee?

Your turkey farm insurance policy can be customized, but the main coverages often included in Tennessee are:

- Livestock insurance: Protects your turkeys against disease outbreaks, theft, lightning, and more.

- Liability insurance: Protects your turkey farm against lawsuits filed by third parties for claims of personal property damage or bodily injury. Coverage pays for legal costs including attorney and court fees.

- Property insurance: Protects your turkey farm’s structures like barns, turkey housing, etc. from the elements of nature, thieves, and more.

- Equipment insurance: Protects your turkey farm’s equipment, tools, and machinery against storm damage, breakdowns, theft, etc.

A Tennessee independent insurance agent can outline a turkey farm insurance policy that meets your needs the best.

How Much Livestock Is Covered under Turkey Farm Insurance in Tennessee?

In short, as much as you want. Work together with your Tennessee independent insurance agent to list each turkey you want your policy to cover. Coverage can vary from actual cash value of each animal to 25% of the total value of all listed animals. Your Tennessee independent insurance agent can help you find a policy that’ll afford you the highest reimbursement in case of disaster.

Turkey Farm Stats for Tennessee

Before you start shopping for coverage, it’s helpful to know some figures for the turkey farm industry. Check out these stats for the turkey farm industry in the US overall.

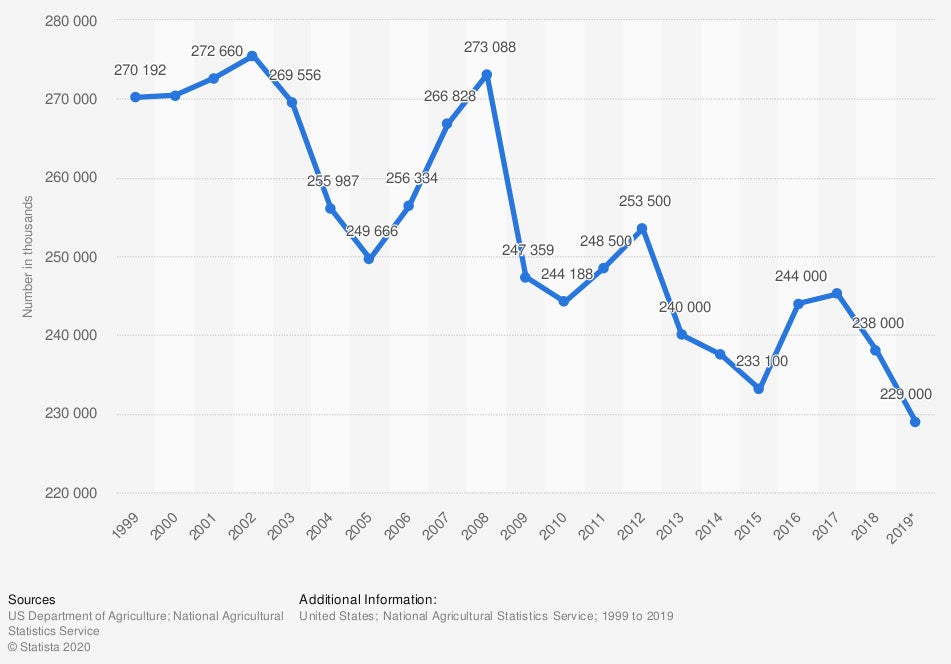

Total number of turkeys produced in the US from 1999 to 2019 (in thousands)

Turkey production in the US was down considerably in 2019 compared to 20 years earlier, in 1999. Before the new millennium, a reported 270 million turkeys were produced in the US. As of 2019, this number had fallen to 229 million. However, the decline has not been steady or consistent over time, with years like 2008 seeing huge spikes in production.

Just because the number of turkeys produced in the US has dropped over the past couple of decades, this doesn’t mean the industry is going away, or that your specific turkey farm doesn’t need protection. Speak with a Tennessee independent insurance agent about the importance of having the proper coverage today.

What’s Not Covered by Turkey Farm Insurance in Tennessee?

While turkey farm insurance provides a lot of critical protection, it can’t cover everything. Martin said that turkey farm insurance policies in Tennessee often exclude the following disasters:

- Flood damage

- Maintenance-related losses

- Failure to maintain equipment

- Insect damage or infestations

- Nuclear fallout or war damage

- Earthquake damage

Your Tennessee independent insurance agent can recommend additional policies that may benefit your turkey farm, such as a flood insurance policy.

Are There Other Policies That Can Provide Additional Protection?

Yes, in fact, Martin said that you may need to add a few additional policies to your turkey farm insurance to get a more complete picture of protection. Some of the most commonly added coverages in Tennessee are:

- Crop insurance: Protects any crops on your turkey farm against common perils like freezing, flood damage, etc. When you’ve got profitable crops, it’s imperative to get them equipped with the proper coverage, just like your turkeys.

- Workers’ compensation: Despite local Tennessee laws for agricultural employees, your team needs protection against injury, illness, and death on the job.

- Commercial auto insurance: If your turkey farm has any company vehicles, they need protection against lawsuits, vandalism, storm damage, and more.

Your Tennessee independent insurance agent will work with you to assemble a turkey farm insurance package that checks all the boxes for your unique business.

Here’s How a Tennessee Independent Insurance Agent Can Help

When it comes to protecting turkey farms against risks like theft, disease, fire, and all other perils, no one’s better equipped to help than an independent insurance agent. Tennessee independent insurance agents search through multiple carriers to find providers who specialize in turkey farm insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/196092/total-number-of-turkeys-raised-in-the-us-since-1999/

https://www.iii.org/article/understanding-crop-insurance

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/insurance-for-specific-businesses/farms-and-ranches

© 2024, Consumer Agent Portal, LLC. All rights reserved.