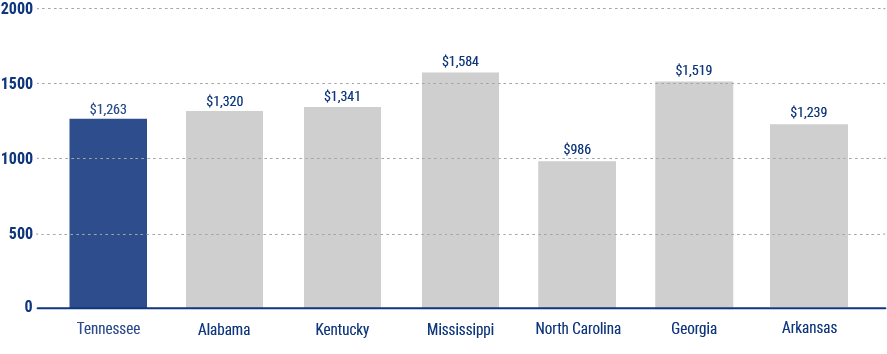

Average Cost of Car Insurance in Tennessee

Vehicle owners in Tennessee pay an average of $1,186 per year for their auto insurance coverage. This is lower than the national average of $1,311. Your actual quoted price for coverage will be calculated based on factors such as the make, model, trim, and year of your car, and even personal details like your driving history, age, occupation, and credit score. Comparing quotes from a variety of insurers lets you be sure that you are getting the coverage you want at a competitive price. Independent insurance agents make comparison shopping easy.

Average Cost of Car Insurance Per Year