Cost of Workers’ Compensation Insurance in Tennessee

In Tennessee, the cost of workers’ compensation insurance is only slightly higher than the national average. Rates are based on your business industry, the number of employees you have and the types of jobs they do, and your company’s overall payroll. While the rates for each job category are regulated by the Tennessee Department of Labor & Workforce Development, policies are issued by commercial providers, who are permitted to offer discounts of up to 25%. This means shopping around for the best price can potentially save your business a lot of money.

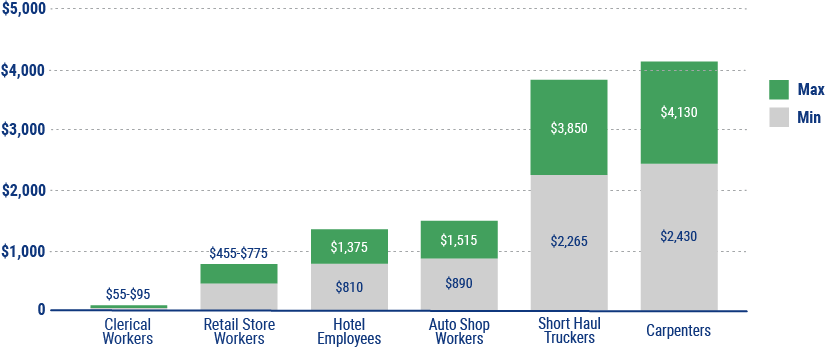

Average Cost Range for Workers' Comp Insurance in Tennessee (Per $50,000/yr in Payroll)