Peach farms offer numerous rewards, but they also come with their own set of exposures. When you own a peach farm, you’ve got to make sure these risks are anticipated from the very beginning. Getting equipped with the right peach farm insurance is a great way to achieve this.

Luckily a Tennessee independent insurance agent can help you find the best coverage for your peach farm. They’ll get you set up with all the peach farm insurance you need long before you need to file a claim. But first, here’s a closer look at this important coverage.

What Is Peach Farm Insurance?

Peach farm insurance is just a specialized type of Tennessee farm insurance tailored to meet the needs of peach farms and their owners. Coverage includes the basics of Tennessee business insurance, with protection for property and revenue, and then gets topped off with more specific coverages for you. Finding the right coverage is quick and easy when you enlist the help of a Tennessee independent insurance agent.

What Are Some Common Risks to My Peach Farm?

When considering peach farm insurance, it’s handy to know the biggest risk factors to your business. There are many things that could go wrong at your peach farm, but here's just a handful.

- Property damage: Whether it’s caused by storms or vandalism, your commercial property such as barns or equipment can get damaged easily. Without the right coverage, it could be expensive to replace.

- Lost income: If a covered disaster like a fire happens on your peach farm and causes you to have to temporarily suspend operations, you could stand to lose some serious income without the right policy.

- Lawsuits: If a visitor or other third party claims that they've been injured or some of their personal property was damaged as a result of your peach farm, you could get sued. Lawsuits can be extremely pricey without the right protection.

Knowing the biggest threats to your peach farm can be beneficial for numerous reasons, including when hunting for the appropriate coverage for you.

What Does Peach Farm Insurance Cover in Tennessee?

Peach farm insurance can be customized, but there are some common protections included in most policies. According to insurance expert Paul Martin, you can expect to find these coverages in your policy:

- Property insurance: For commercial structures like sheds, fences, silos, etc. Covered perils include storm damage, vandalism, and more.

- Equipment insurance: For commercial equipment, tools, and machinery.

- Liability insurance: For lawsuits filed against you by third parties. Coverage pays for attorney and court costs.

A Tennessee independent insurance agent can outline exactly which coverages are included in a basic peach farm insurance policy.

Peach Farm Production in the US

When shopping for coverage, it’s helpful to know a bit about your industry as a whole. Check out some stats for peach farming in the US below.

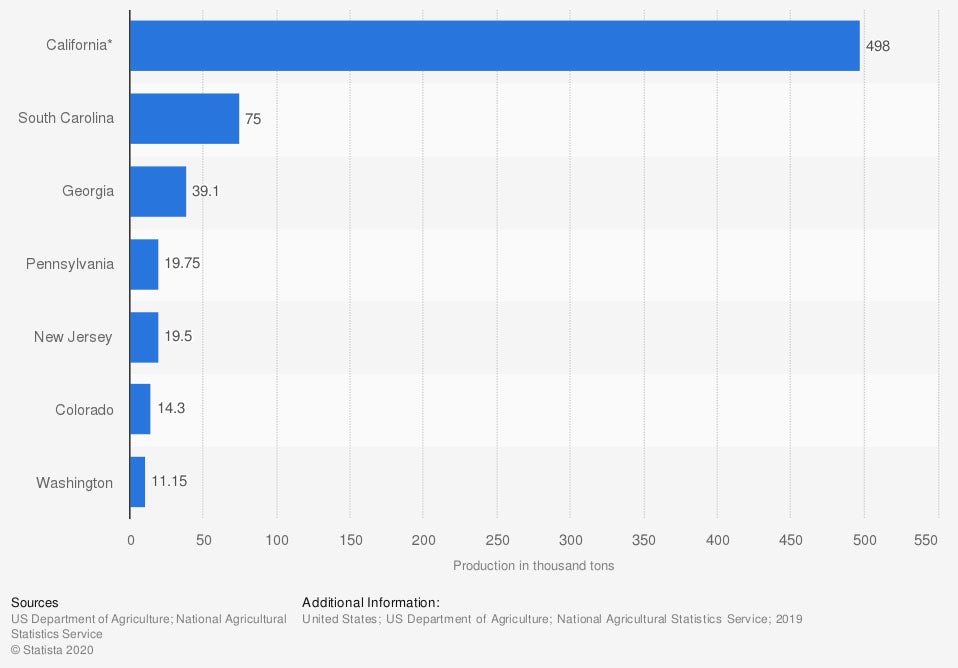

Peach production in the United States in 2019, by state (in 1,000 tons)

As of 2019, the leading states for peach production in the US included California, South Carolina, Georgia, Pennsylvania, and New Jersey. California produces by far the most peaches in the nation, with a reported 498,000 tons in 2019 alone.

Peach farming is a huge industry. That makes it all the more important to have the right protection for your specific peach farm.

Are There Other Policies That Can Provide Additional Protection?

Yes, your peach farm insurance policy might greatly benefit from adding more coverages. According to insurance expert Paul Martin, these coverages are typically added to peach farm policies in Tennessee:

- Crop insurance: To protect any crops on your peach farm against disasters like freezing, flood damage, and more. Your peaches especially need this protection.

- Commercial auto insurance: To protect any company vehicles used against lawsuits, vandalism, storm damage, and more.

- Workers’ compensation: To protect your peach farm’s workers against injury, illness, and death on the job. Tennessee may not legally require this coverage for agricultural employees, but it’s still crucial to have it.

Your Tennessee independent insurance agent can recommend any additional coverages they feel will benefit your peach farm the most.

What’s Not Covered by Peach Farm Insurance in Tennessee?

While your peach farm policy will provide a ton of critical protection, it also comes with certain exclusions. Martin said that peach farm insurance often won’t cover:

- Earthquake damage

- Flood damage

- Insect damage or infestations

- Failure to maintain equipment

- Nuclear fallout or war damage

- Maintenance-related losses

If floods or earthquakes are common in your area, work with your Tennessee independent insurance agent to add a separate flood insurance or earthquake insurance policy.

Here’s How a Tennessee Independent Insurance Agent Can Help

When it comes to protecting peach farms against risks like theft, disease, fire, and all other perils, no one’s better equipped to help than an independent insurance agent. Tennessee independent insurance agents search through multiple carriers to find providers who specialize in peach farm insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/193929/top-10-peach-producing-us-states/

https://www.iii.org/article/understanding-crop-insurance

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/insurance-for-specific-businesses/farms-and-ranches

© 2024, Consumer Agent Portal, LLC. All rights reserved.