There are more than 600,000 small businesses in Tennessee, and tens of thousands of them are self-employed businesses. Even if you work for yourself, you can benefit from business insurance.

A Tennessee independent insurance agent knows the ins and out of the business insurance market in the state. They can help you find the best protection for your business. But first, let's determine whether self-employed insurance is right for you.

What Is Self-Employed Insurance?

If you're trading service for money, then you run a business. Self-employed insurance is a package of business insurance coverages that protect you and your business from a variety of potential risks.

Self-employed insurance can come in many shapes and sizes, depending on the type of business you run. Some of the policy options to consider include:

- Health insurance

- General liability insurance

- Commercial auto insurance

- Personal liability insurance

- Commercial property insurance

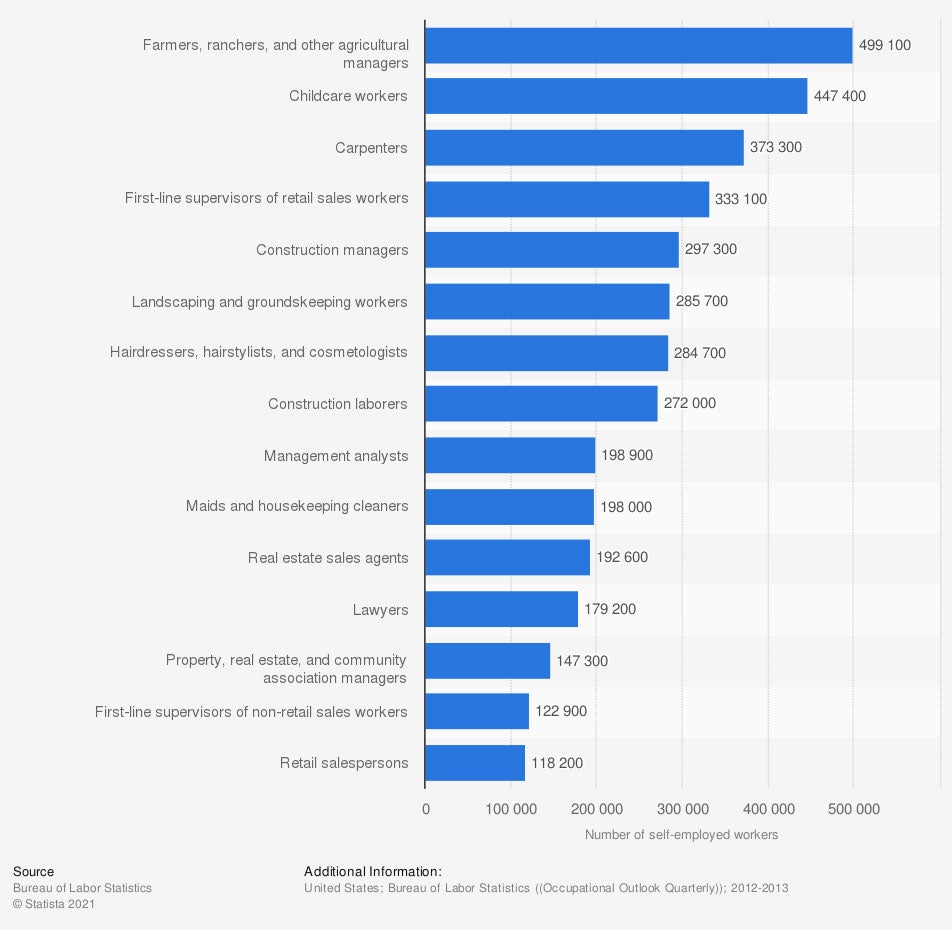

Projection of the occupations with the most self-employed workers in the US for 2022

The number of self-employed workers is expected to continue to grow over the next several years. Farmers and ranchers are projected to be the occupation with the most self-employed workers in 2022, with 499,100 self-employed people.

What Does Self Employed Insurance Cover in Tennessee?

Depending on which policies you choose to purchase, self-employed insurance can cover everything from liability cases and property damage to health insurance.

- Health insurance: Provides health care coverage and benefits for you and your family.

- General liability insurance: Protects your business against third-party injury claims.

- Personal liability insurance: Also known as errors and omissions, provides coverage if your work results in financial losses to a third party.

- Commercial property insurance: Covers all the property of your business, including office equipment, inventory, and your office space.

- Commercial auto insurance: Provides coverage for any vehicles that are used solely for business purposes.

If you're unsure about which coverage is the best for you, your Tennessee independent insurance agent can help you decide. They'll go through your business risks with you and suggest the best policies.

Best Health Insurance for Being Self-Employed in Tennessee

One benefit of working for a company is that they typically provide health benefits. When you're self-employed, you're in charge of your own healthcare.

According to insurance expert Jeffrey Green, self-employed health insurance is individual health insurance available through the marketplace or other insurance plans. Each provides different benefits.

- The marketplace: The marketplace is offered through the government. You can shop multiple insurance offerings for yourself and your family and apply for insurance policies. The marketplace is available for freelancers, consultants, independent contractors, and other self-employed workers who don't have any employees.

- Private health insurance: You can purchase private health insurance through a Tennessee independent insurance agent or directly through an insurance carrier.

What Self-Employed Health Insurance Deductions Are Available?

When you are self-employed and paying for your own health insurance, you are eligible for a variety of deductions on your taxes. In fact, you can deduct all of the following health-related costs:

- Any paid health insurance premiums

- Any paid dental insurance premiums

- Qualified long-term care insurance premiums

You can also deduct any premiums you pay for a spouse or dependents if your self-employed health insurance includes your family.

Tennessee Disability Insurance for Being Self-Employed

Disability insurance can help pay for bills and other expenses should you become disabled. While it might seem unlikely that you'll suffer a short-term or long-term disability, if it happens, it can be devastating to your self-employment.

You'll need to decide whether you need short-term, long-term, or both.

- Short-term disability insurance: Temporary coverage for less serious injuries. It's expected that a full recovery will be made from a short-term disability.

- Long-term disability insurance: Coverage for serious injuries that may last an extended period of time. It will also cover permanent disabilities.

Disability insurance will pay anywhere from 40% to 70% of your income for the length of your disability. Your Tennessee independent insurance agent can discuss disability insurance options with you to determine what will best fit your needs.

How a Tennessee Independent Insurance Agent Can Help

Self-employment provides flexibility and autonomy, but requires some decisions that include being properly protected. A Tennessee independent insurance agent understands the risks that self-employed individuals face.

When you're looking for a good Tennessee business insurance policy, they'll shop multiple carriers and present you with several quotes to choose from. Should you need to add or take away from your policy, they can help make adjustments and ensure that you always have the best protection.

Author | Sara East

Article Reviewed by | Jeffery Green

https://www.irs.gov/pub/irs-pdf/p535.pdf

https://www.meetbreeze.com/disability-insurance/disability-insurance-for-self-employed/

https://www.healthcare.gov/self-employed/coverage/

© 2024, Consumer Agent Portal, LLC. All rights reserved.