In Tennessee, protection for your operation is necessary to avoid significant financial loss. There are a number of things that can go wrong when you own a company. That's why Tennessee business insurance for your retail store is so essential.

The best way to get started is by contacting a Tennessee independent insurance agent. They do the shopping for you at no additional cost. Connect with a local expert for tailored quotes in minutes.

What Is Retail Store Insurance?

Your Tennessee retail store insurance will have several policy types. It's important to obtain quotes for every exposure. Check out some common coverage choices for retail stores below:

- General liability

- Business property

- Business inventory

- Business equipment breakdown

- Commercial umbrella liability

- Workers' compensation

Employment practices liability and commercial auto insurance are other coverages you'll want to consider as well. When you own a retail business, it's good to know the projected sales.

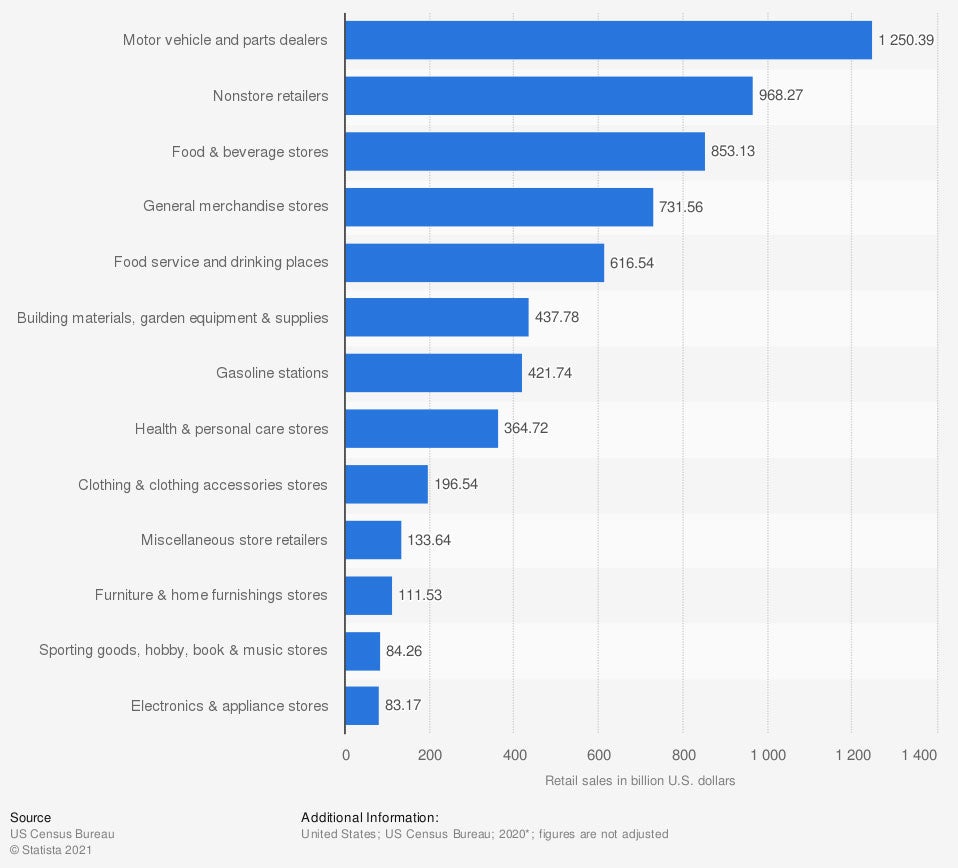

Annual retail sales by store type in the US (in billion US dollars)

The category your business falls into can help determine your estimated piece of the pie. Many varying factors will contribute to these numbers, and not all companies are the same.

What Does Retail Store Insurance Cover in Tennessee?

In Tennessee, there are 603,310 small businesses in operation. Your retail store insurance will have specific coverages just like any other commercial insurance policy. Let's look at common retail store coverages:

- Coverage for bodily injury or property damage claims

- Coverage for your business inventory such as products

- Coverage for business equipment that breaks down due to a covered loss

- Coverage for employees who are injured or become ill on the job

- Coverage for commercial vehicles used to operate the business

- Coverage for disgruntled employees that sue due to discrimination or harassment

Every policy will come standard with basic coverages that come automatically included. Your Tennessee insurance will typically come with protection against the below perils automatically:

- Fire

- Natural disasters

- Theft

- Vandalism

- Water damage (not from a direct flood loss)

How Much Is Retail Store Insurance in Tennessee?

In Tennessee, $6,317,565,000 in commercial insurance claims were paid in 2019 alone. All of your insurance policies will be unique to your operation. Take a look at the factors companies look at when quoting:

- Loss history

- Replacement cost values

- Insurance score

- Experience level

- Type of retail store

- Location

Other items carriers look for are local crime rates and weather patterns. To save instantly, consider bundling your coverage. When you bundle all your policies with the same company, you'll save 30% or more across all of your policies.

How Much Theft Is Covered with Tennessee Retail Store Insurance?

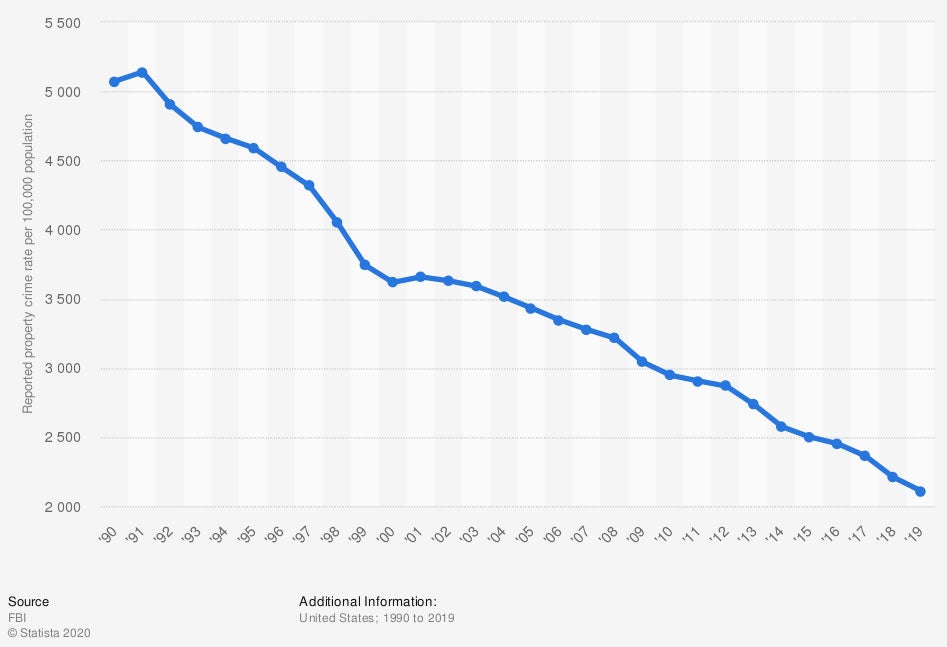

Coverage for theft and vandalism for your Tennessee business can save you thousands of dollars in loss. Your primary policies will provide coverage for these types of claims so that you're not in a bind. Take a look at the property crime rates below:

Reported property crime rates in the US (per 100,000 population)

Your commercial insurance costs will be affected by local crime in your state. While you won't have control over this, you can still know how it affects your premiums.

Will My Tennessee Location Impact My Rates?

Tennessee has 6,541,223 residents and counting. This growing state has many areas where you can park your retail business. Your location will impact your rates, and it is good to know how.

Every property is assigned a flood zone, and this will determine if you are required to carry flood insurance. While all locations are at risk for flooding, you'll be mandated to have a separate flood policy if you're in zone A or V. This will affect the amount you pay annually in insurance.

How an Independent Insurance Agent Can Help in Tennessee

Tennessee retail store insurance can be found through a licensed professional. Instead of going it alone, consider using a trusted adviser that understands the coverage your business needs. There are multiple options when it comes to protection, and it can be confusing.

Fortunately, a Tennessee independent insurance agent can help with premiums and policy choices. They work on your behalf at zero cost to your business. Connect with a local expert in minutes and start saving today.

Article Author and Expert | Candace Jenkins

Graph #1: https://www.statista.com/statistics/289776/us-retail-annual-sales-store-type/

Graph #2: https://www.statista.com/statistics/191237/reported-property-crime-rate-in-the-us-since-1990/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.