Pig farms have many components that need to be protected at all times. From your livestock to your business’s revenue, there are many disasters that could strike and hit hard without the proper coverage. That’s why having the right pig farm insurance is so important.

Fortunately a Tennessee independent insurance agent can help you address the needs of your pig farm and help you find the right type of insurance for your unique business. But until then, here’s a closer look at this critical coverage.

What Is Pig Farm Insurance?

Pig farm insurance is basically a special form of Tennessee farm insurance designed to cover the needs of pig farms, specifically. Coverage often includes the basics of liability protection, along with property damage coverage and livestock protection. Beyond these core coverages, specialty protections can be added to meet your pig farm’s needs even further. Working with a Tennessee independent insurance agent is the best way to get set up with all the right coverage.

What Does Pig Farm Insurance Cover in Tennessee?

Your pig farm insurance policy may vary a bit from your neighbor’s, since this coverage is highly customizable. However, the main coverages often included in pig farm insurance are:

- Livestock protection: Your pigs themselves need protection against disease outbreaks, theft, lightning, and more. Just one incident could wipe out your entire drove, which could be devastating for your pig farm.

- Legal protection: Your pig farm is also at risk of being sued by third parties for claims of personal property damage or bodily injuries. Pig farm insurance provides liability coverage to take care of attorney and court fees if you face a lawsuit.

- Property protection: Your pig farm’s structures like sheds, fences, silos, pig housing, etc., all need their own property protection against the elements of nature and more.

- Equipment protection: Your pig farm’s equipment, tools, and machinery need coverage against storm damage, breakdowns, theft, etc.

A Tennessee independent insurance agent can further explain the basic coverages provided by pig farm insurance.

Pig Farm Stats for Tennessee

When considering coverage for your pig farm, it’s handy to know just how impactful the industry is in your area, and the country overall. Check out these stats for pig farms in the US below.

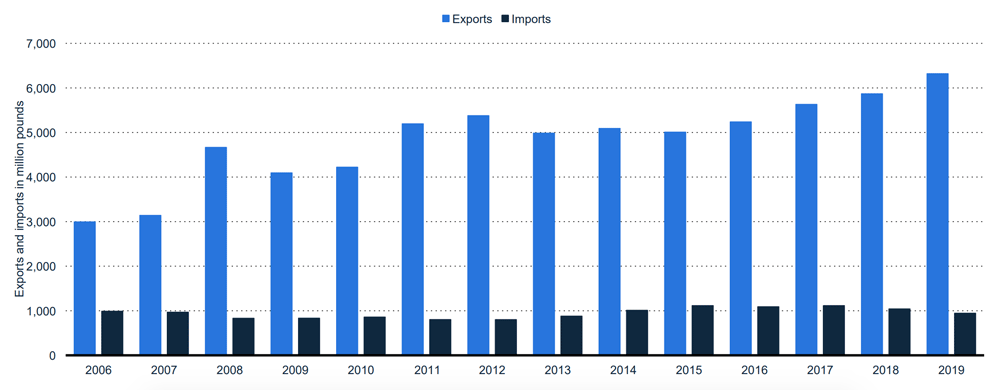

Total US pork imports and exports from 2006 to 2019 (in million pounds)

The amount of pork exports in the US has grown significantly over the years. In 2006, the US exported about three billion pounds of pork. By 2019, the amount of pork exports from the nation more than doubled, exceeding six billion pounds.

With pig farming becoming increasingly prevalent over time, having the proper protection for your business is a must as the industry continues to expand.

Are There Other Policies That Can Provide Additional Protection?

There are several optional coverages you can add onto the core package of your pig farm insurance. According to insurance expert Paul Martin, commonly added coverages to pig farm insurance in Tennessee include:

- Workers’ comp: Many states do not actually require agricultural businesses to have workers’ comp coverage for their employees. However, despite local Tennessee laws, your workers need protection against injury, illness, and death on the job.

- Crop insurance: Crop insurance can protect any crops on your pig farm against disasters like freezing, flood damage, and more. If your pig farm has profitable crops, it’s critical to get them equipped with just as much coverage as your pigs have.

- Commercial auto insurance: Commercial auto insurance can protect any company vehicles used against liability claims from third parties, vandalism, storm damage, and more. If your farm takes vehicles out on the road for business purposes, this is a critical coverage to add.

Your Tennessee independent insurance agent will work with you to assemble a pig farm insurance package that meets all of your unique business’s needs to the fullest extent.

What’s Not Covered by Pig Farm Insurance in Tennessee?

Pig farm insurance provides a ton of crucial protection, but it also comes with a set of exclusions, which are important to review with your agent. Martin said that pig farm insurance usually doesn’t cover:

- Insect damage or infestations

- Nuclear fallout or war damage

- Earthquake damage

- Flood damage

- Maintenance-related losses

- Failure to maintain equipment

Your Tennessee independent insurance agent can help you find a separate flood insurance or earthquake insurance policy, if these disasters are common in your area.

How Much Livestock Is Covered under Pig Farm Insurance in Tennessee?

You’ll need to work with your Tennessee independent insurance agent to list the animals you want covered on your pig farm insurance policy. Depending on your policy, each pig may be covered up to its actual cash value in case of a disaster. However, your policy may state that each pig is only covered up to 25% or so of the total value of all animals scheduled. You can choose a policy that best meets your needs in this category.

Here’s How a Tennessee Independent Insurance Agent Can Help

When it comes to protecting pig farms against risks like theft, disease, fire, and all other perils, no one’s better equipped to help than an independent insurance agent. Tennessee independent insurance agents search through multiple carriers to find providers who specialize in pig farm insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

https://www.thebalancesmb.com/livestock-insurance-4175992

https://www.statista.com/study/44286/hog-and-pig-farming-in-the-us/

https://www.almanac.com/fact/what-does-one-call-a-group-of#:~:text=Answer%3A%20A%20group%20of%20pigs,swine%20is%20called%20a%20sounder.

© 2024, Consumer Agent Portal, LLC. All rights reserved.