In Tennessee, $6,317,565,000 in commercial insurance claims were paid in 2019 alone. The right coverage for your entity is necessary to avoid a huge financial loss. Tennessee business insurance can help protect your nonprofit.

Fortunately, a Tennessee independent insurance agent has a network of carriers so that you get the best policy for a fair price. They'll do the shopping at no additional cost, saving you time and premium dollars. Connect with a local expert for tailored quotes.

What is Nonprofit Insurance?

Tennessee nonprofit insurance is similar to other business insurance policies you'd obtain. There may be some specific coverage for the board of directors, but most of the time, coverage is the same as other entities. Check out how it works:

- Nonprofit insurance: Coverage for losses arising out of bodily injury, property damage, slander, commercial auto, and more.

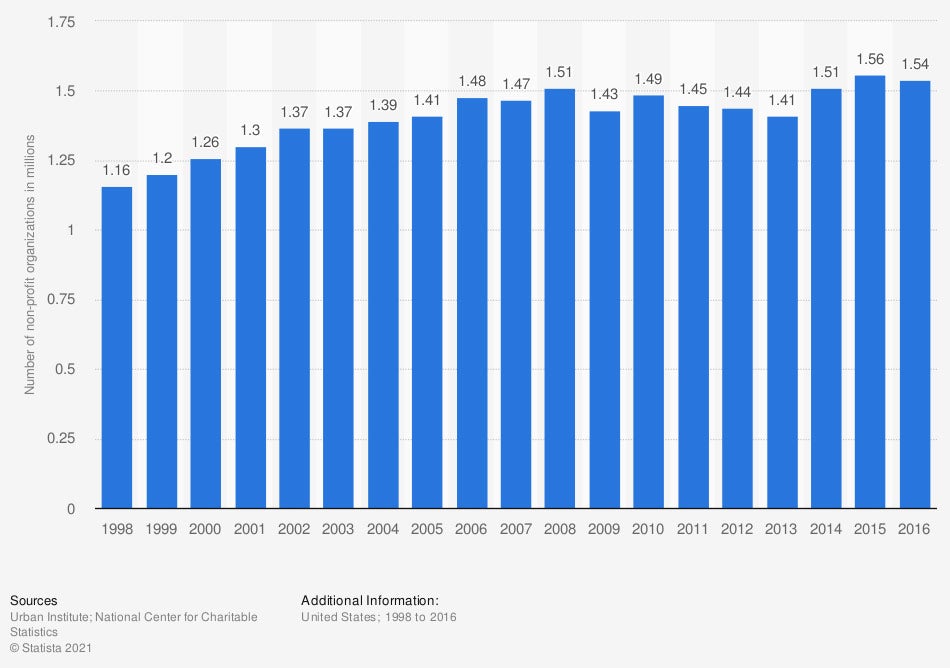

Number of US nonprofits from 1998 to 2016 (in millions)

If you have a nonprofit in Tennessee, you're not alone. It's essential to know what coverage pertains to your operation.

What Does Nonprofit Insurance Cover in Tennessee?

Your nonprofit insurance will have some of the same policies as commercial coverage. All insurance policies will be tailored to your operations as a nonprofit. Some key items that nonprofit insurance will cover in Tennessee are as follows:

- General liability insurance: Pays for claims of bodily injury or property damage where you and your employees are responsible.

- Business interruption: This will pay for regular business expenses when you are temporarily shut down due to a covered loss.

- Commercial property insurance: Pays for damage to your building, equipment, and inventory from a covered loss.

- Crime insurance: Pays for a claim involving forgery, fraud, or theft to your company.

- Directors and officers insurance: This protects the board of directors of the nonprofit from claims of negligence, slander, and misconduct.

How Much Is Nonprofit Insurance in Tennessee?

Tennessee has 603,310 small businesses that are currently in existence. The cost of your insurance will vary depending on your unique nonprofit. Carriers look at the following items when rating your nonprofit policy:

- Policies and procedures in place

- If you have any volunteers

- If you deal with minors

- Prior claims

- Backgrounds of all board members

- How monies and securities are handled

Will My Location Impact My Rates in Tennessee?

Where your Tennessee nonprofit is located will affect your insurance rates. Carriers look at everything from local crime rates to weather patterns when calculating your costs.

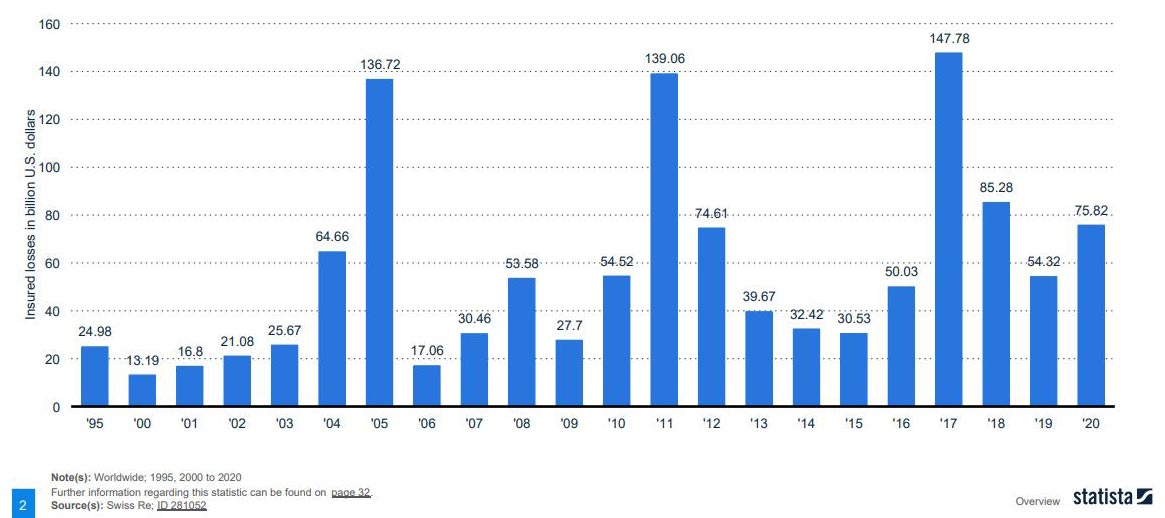

Insured losses caused by natural disasters worldwide (in billion US dollars)

One item you'll want to have separate coverage for is flood insurance. Each location is assigned a flood zone that will impact your costs. Flood insurance is necessary on every policy, but is typically only required if you're in an A or V zone.

How an Independent Insurance Agent Can Help in Tennessee

Tennessee nonprofit insurance can be obtained through a local adviser. Instead of going it alone, consider using a licensed professional. They review your coverage at no cost to you, making it a no-brainer.

A Tennessee independent insurance agent can help with policy and premium options. Since they have a network of carriers, you'll have rates that fit your budget. Connect with a local expert on TrustedChoice to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/189245/number-of-non-profit-organizations-in-the-united-states-since-1998/

Graphic #2: https://www.statista.com/study/11801/catastrophe-losses-of-the-insurance-industry-statista-dossier/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.