Tennessee has 603,310 small businesses in operation. When you're running a company, it's both exciting and rewarding at the same time. Tennessee commercial coverage will offer liability insurance to help protect your livelihood from financial ruin.

A Tennessee independent insurance agent will review your policies for free, catching any gaps. They'll even do the shopping for you through their network of carriers. Connect with a local expert to get started today.

What Is Liability Insurance Coverage?

There are numerous kinds of liability policies depending on the type of industry. In essence, all liability policies will have the same foundational coverages:

- Liability insurance: Will pay for a lawsuit arising from bodily injury, property damage, or slander. It can be obtained for business and personal use.

What Is Tennessee Commercial General Liability Insurance?

Commercial general liability insurance in Tennessee is a vital policy for any business owner. This is the primary coverage for your company and can help cover a variety of claims. Take a loot at where general liability insurance could help:

- A customer slips and falls on-premises

- A building catches on fire

- A product is improperly installed, causing a water loss

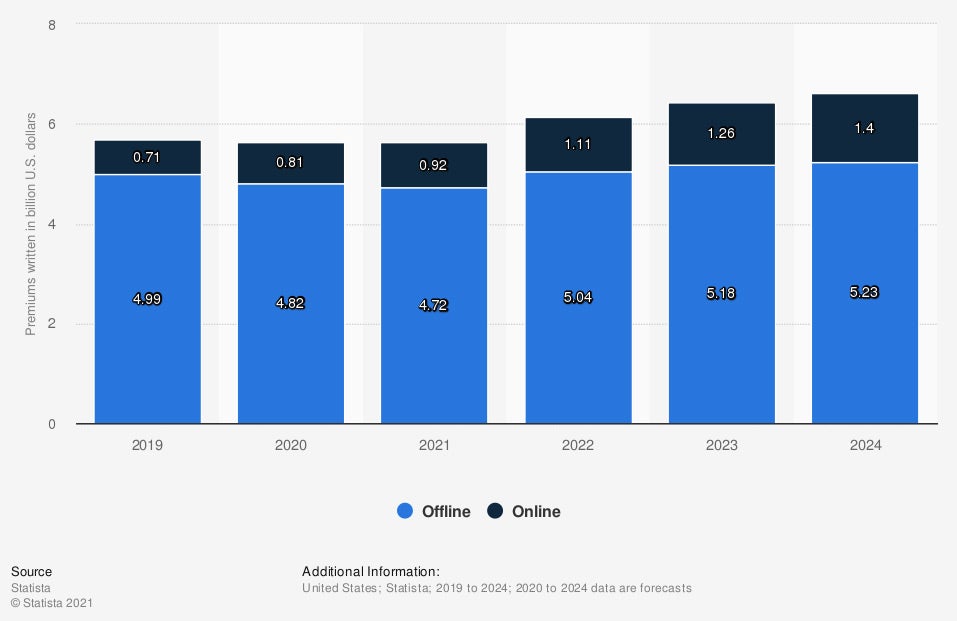

Value of B2C general liability insurance premiums written online and offline in the US (in billion US dollars)

If you work with another company during the year, they will typically require your business to carry a general liability policy. Limits equal to or greater than those for other operations you do work for are necessary.

What Is Tennessee Professional Liability Insurance?

Professional liability insurance is used when you're in the business of advising. If you are known for providing consultation in any form, you'll want this policy for protection against lawsuits due to negligent or mistaken advice. Some industries where professional liability applies in Tennessee are as follows:

- Accountant

- Lawyer

- Real estate agent

- Insurance agent

- Financial adviser

- Business broker

What Is Employment Practices Liability Insurance Coverage in Tennessee?

An employment practices liability policy will protect your business from employee-related discrimination lawsuits. Check out what it covers:

- Employment practices liability insurance or EPLI: Pays for a lawsuit filed by a disgruntled employee due to discrimination or sexual harassment in any form.

What Is Liability Coverage on Home Insurance in Tennessee?

Every Tennessee homeowners insurance policy comes with a personal liability limit. You and your adviser preselect this coverage amount before a loss. Take a look at some instances where liability protection could apply:

- A guest or trespasser injures themselves on your property.

- Your tree falls and damages your neighbor's roof.

- You have a pool party, and a guest drowns.

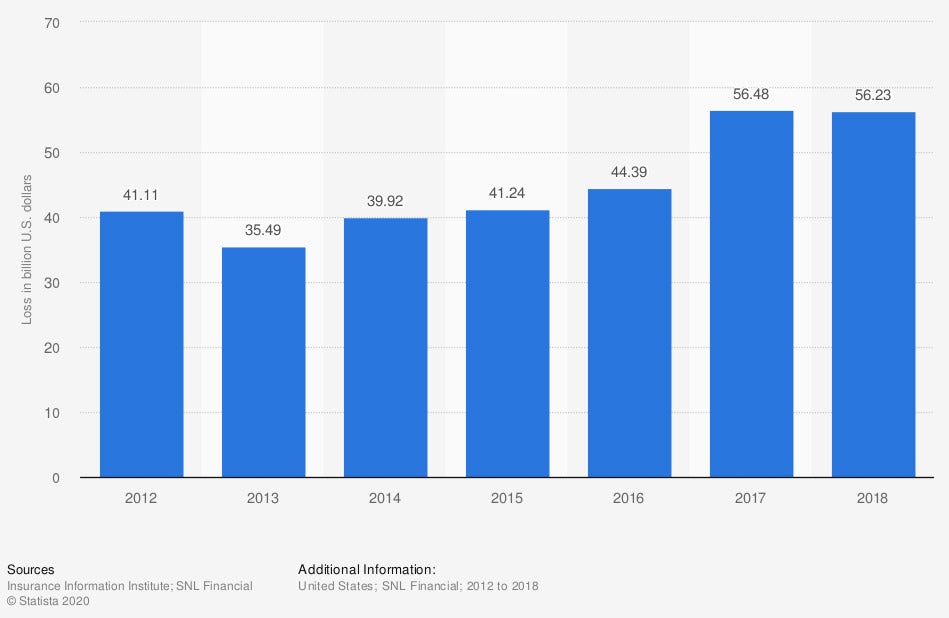

Incurred losses for homeowner insurance in the US (in billion US dollars)

It's essential to pick high enough liability limits to avoid paying out of pocket for a claim. Coverage options start at $100,000 and go up from there.

What's the Difference between Full Coverage and Liability Insurance in Tennessee?

Full coverage in Tennessee will refer to your personal or commercial auto insurance. Your car policies will only come with the minimum limits of liability. If you want more protection, you'll need to add it. Take a look at the difference:

- Liability-only insurance: This is just liability coverage at the amount preselected for your auto policy. It will pay for bodily injury per person and per accident, and property damage of another party.

- Full coverage insurance: This will include additional coverages that protect you on the road. Comprehensive, collision, towing, and more are among the optional coverages you can select.

How a Tennessee Independent Insurance Agent Can Help

When you're searching for commercial insurance, the first policy usually starts with liability coverage. From there, your other limits of protection are added to fill any gaps. A trusted professional will be able to review your policies for free so you have peace of mind.

A Tennessee independent insurance agent has access to a network of carriers, making it a no-brainer. Connect with a local expert on trustedchoice.com for tailored quotes in minutes. They'll even compare coverage and rates to make it super easy.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/1119019/value-b2c-liability-insurance-premiums-written-usa/

https://www.statista.com/statistics/428998/incurred-losses-for-homeowners-insurance-usa/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.