Tennessee has 1,100,000 people that work for small businesses. If you rely on staff to run your operation, you'll need the proper coverage. Tennessee business insurance can include employment practices liability protection.

A Tennessee independent insurance agent has access to several markets so that you get the most affordable premiums. They do the shopping for you at no additional cost. Connect with a local expert for tailored protection in minutes.

What Is Employment Practices Liability Insurance?

If you're a Tennessee small business, you probably don't have extra cash flow to pay for lawsuits. When you hire employees, you're responsible for what could go wrong. Check out the coverage that can help:

- Employment practices liability insurance (EPLI): Pays for your legal defense when an employee files a lawsuit against you. This can be a claim due to discrimination, sexual harassment, and many others.

What Does Employment Practices Liability Insurance Cover in Tennessee?

In Tennessee, $6,317,565,000 in commercial insurance claims were paid in 2019 alone. The right policy can protect you from a variety of employee-related lawsuits. EPLI provides coverage for legal expenses arising from the following claims:

- Sexual harassment

- Wrongful termination

- Breach of an employment contract

- Discrimination

- Violation of local and federal employment laws

- Infliction of emotional distress or mental anguish

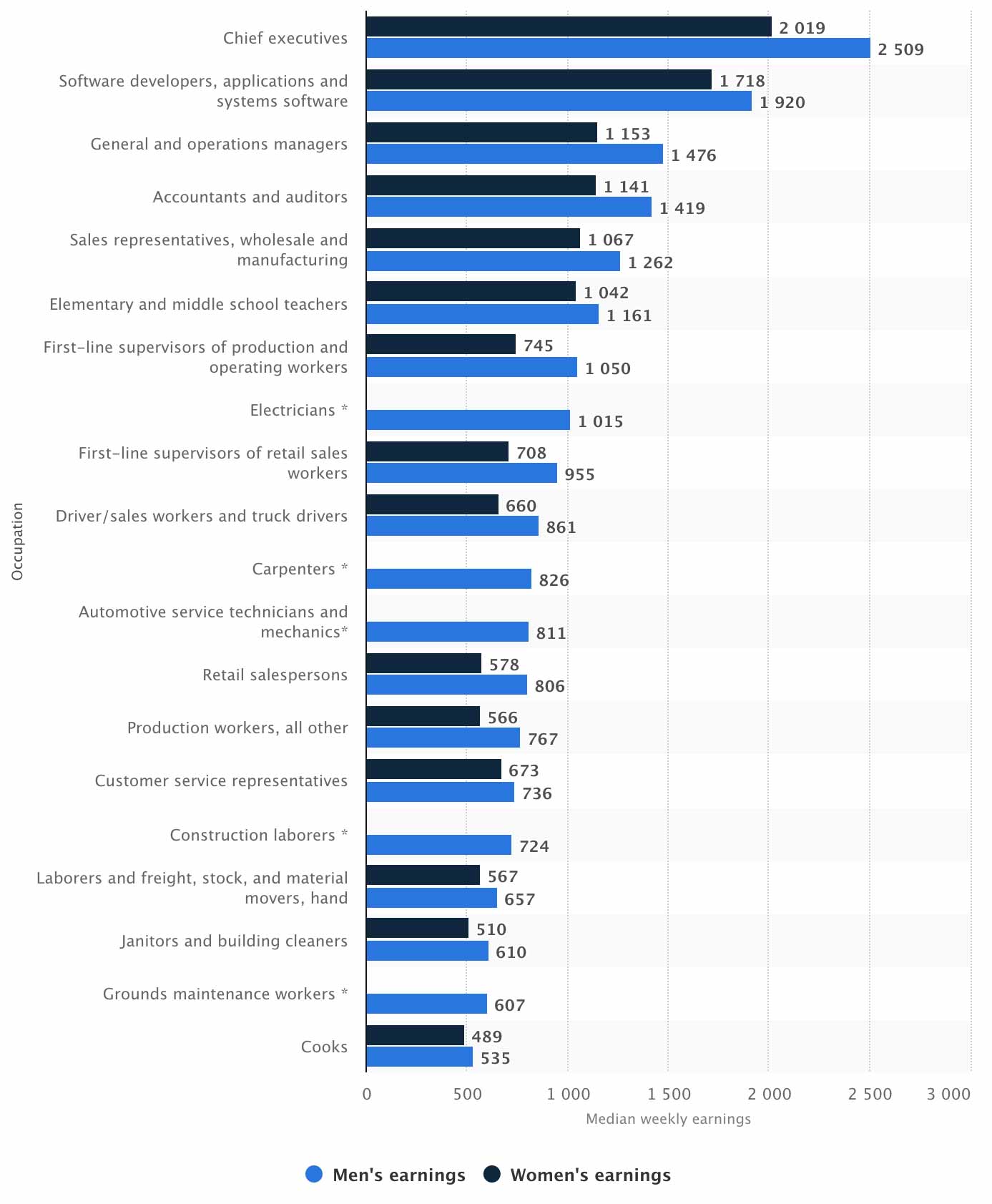

Gender wage gap for most common occupations for men in the US in 2019, by median weekly earnings (in US dollars)

Some other claims that can come up are failure to employ or promote, mismanagement of employee benefits, defamation of character, and privacy violations.

What Doesn't Employment Practices Liability Insurance Cover in Tennessee?

Your commercial insurance policies will be specific to your industry and come with exclusions. Check out what losses a Tennessee EPLI could deny:

- If your company violates an industry-standard guideline from OSHA, a claim will be voided.

- When there is a data breach, EPLI will not cover any damages that arise from stolen employee information.

- There will be exclusions for punitive damages or criminal act losses as well.

- Workers' compensation coverage is a separate policy you'll need to obtain to pay for employee injuries.

Employment Practices Liability Insurance Cost in Tennessee

Your employment practices liability insurance will have unique pricing based on your operation. Carriers look at several items when quoting your coverage. In Tennessee, employment practices liability premiums are rated on the following factors:

- Your experience level

- The safety practices you have in place

- If you have a human resources department

- How you deal with hiring

- How you deal with termination

- Prior claims reported

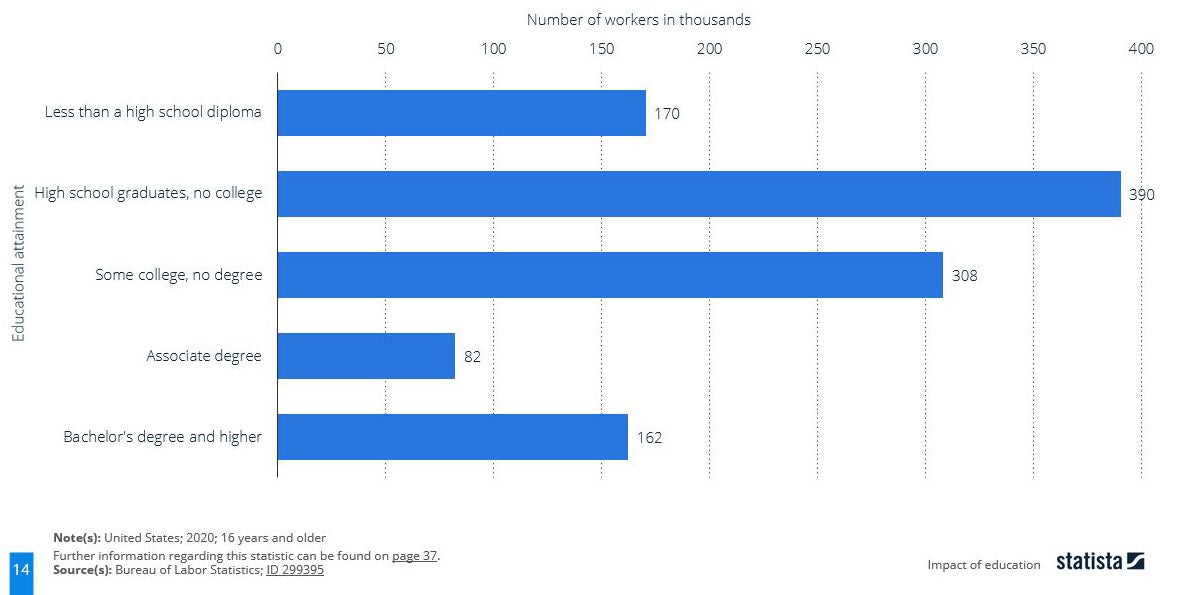

Number of employees paid below minimum wage in the US in 2020, by educational attainment (in thousands)

The cost of your employment practices liability insurance will pale in comparison to a lawsuit. Check with a local adviser to make sure your policies are sufficient.

Employment Practices Liability Insurance Third-Party Coverage in Tennessee

Third-party EPLI can often be overlooked but is necessary to have complete protection. Your business could encounter parties that could file a claim against your company for discrimination. Check out what third-party employment practices liability covers in Tennessee:

- Third-party employment practices liability coverage: This is a separate insuring agreement within employment practices liability insurance (EPLI). It covers liability claims brought by non-employees against employees of your business.

How to Work with a Tennessee Independent Agent

In Tennessee, you'll have multiple policy options to choose from when it comes to your business. When you have employees, you'll need specific coverages for adequate protection. Employment practices liability insurance can save you from financial ruin if a team member sues you.

A Tennessee independent insurance agent can help you find a policy that will fit your budget and coverage needs. They do the shopping at zero cost with several carriers so that you're protected. Connect with a local expert on TrustedChoice for quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/study/11647/wage-inequality-in-the-us-statista-dossier/

Graphic #2: https://www.statista.com/study/11647/wage-inequality-in-the-us-statista-dossier/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.