In 2019, Tennessee had $6,317,565,000 in commercial insurance claims paid. The right protection for all your risk exposures is necessary if you want to avoid any out-of-pocket losses. Tennessee business insurance can help cover your grocery store against claims.

A Tennessee independent insurance agent will have access to a network of carriers so that you have options. Since they do the shopping for you at no cost, you'll save time and premium dollars. Connect with a local expert for tailored quotes in minutes.

What Is Grocery Store Insurance?

When you proactively purchase your business insurance, you can rest assured that you're fully protected. Your Tennessee grocery store coverage can help with liability, property, and employee-related claims. Check out some common coverage choices for grocery stores below:

- General liability

- Business property

- Business inventory

- Workers' compensation

- Business auto

- Employment practices liability

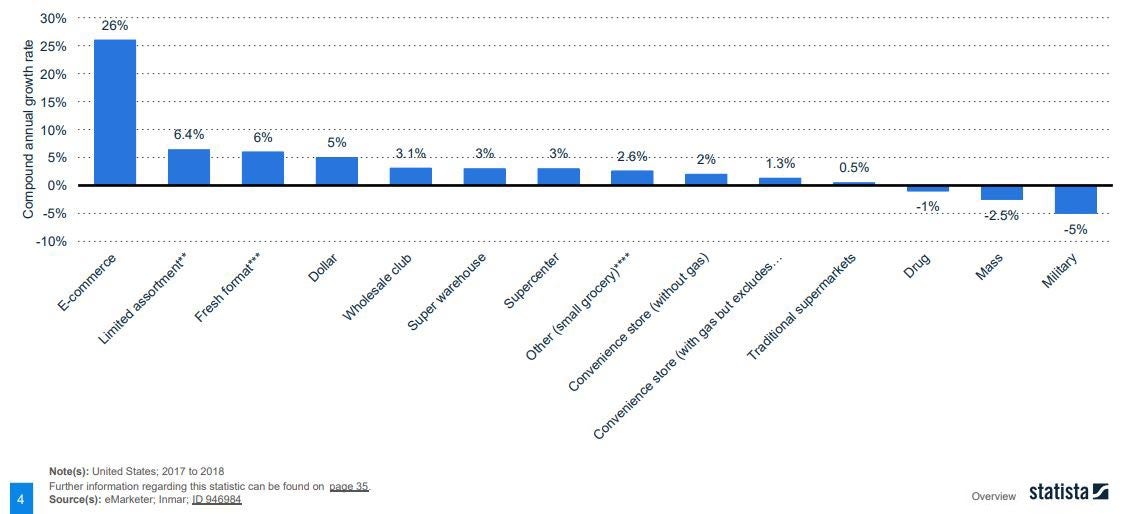

Compound annual growth rate of grocery store sales in the US, by retailer type

Grocery stores are a way of life and where most Americans obtain their food. It's essential to know where most US shoppers spend their money when purchasing sustenance.

What Does Grocery Store Insurance Cover in Tennessee?

Tennessee has 603,310 small businesses in existence. When you own a grocery store, you'll have specific policy requirements. Let's look at common grocery store coverages:

- Coverage for claims for bodily injury or property damage

- Coverage for food and inventory spoilage

- Coverage for your business property that is damaged due to a covered loss

- Coverage for employees who are injured or become ill on the job

- Coverage for commercial vehicles used to operate the business

- Coverage for disgruntled employees that sue due to discrimination or harassment

All grocery store policies will have protection against the same perils. Below is a list of what you can expect to be insured under your coverages:

- Fire

- Natural disasters

- Theft

- Vandalism

- Water damage (not from a direct flood loss)

How Much Is Grocery Store Insurance in Tennessee?

Every business will have unique premiums specific to their daily operations. Your Tennessee Grocery store insurance is no different. Take a look at the factors companies use when quoting:

- Loss history

- Replacement cost values

- Experience level

- Location

- Local crime rate

- Local weather patterns

Will My Location Impact My Rates in Tennessee?

Where your Tennessee grocery store is located will determine your insurance costs, among other things. Carriers look at local crime rates, flood zoning, and weather when setting your insurance price.

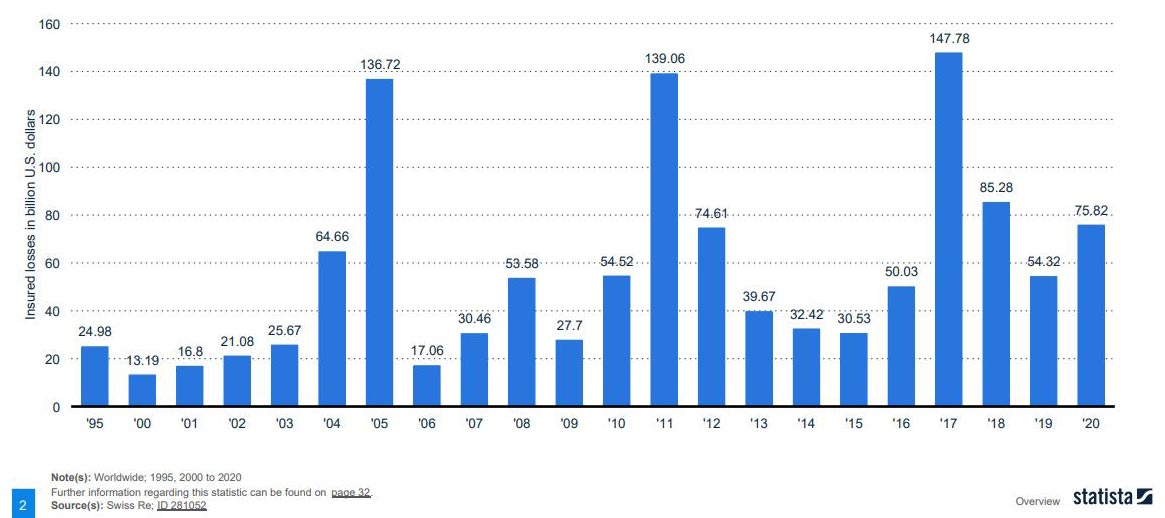

Insured losses caused by natural disasters worldwide from 1995 to 2020 (in billion US dollars)

Another thing that can affect your premiums is flood insurance. Every property is at risk for flooding, and some may be more at risk than others. If you are in flood zone A or V, you will be required to carry a separate flood policy.

How an Independent Insurance Agent Can Help in Tennessee

Your commercial coverage in Tennessee will keep your business well protected from risk. It can be challenging to know which policy is right for you if you're not a licensed professional. An adviser can review grocery store insurance for accuracy.

A Tennessee independent insurance agent will have access to several markets so that you have options. They do the shopping for you at zero cost to your business. Connect with a local expert on TrustedChoice to get custom quotes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/study/20820/us-consumers-online-grocery-shopping-statista-dossier/

Graphic #2: https://www.statista.com/study/11801/catastrophe-losses-of-the-insurance-industry-statista-dossier/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.