When you own a cotton farm, you’ve got to anticipate numerous risks that could harm your business from the beginning. From fires to diseases, many threats could wipe out your crops and seriously hurt your business. That’s why it’s crucial to find the right type of cotton farm insurance.

Luckily a Tennessee independent insurance agent can help you find the best coverage for your cotton farm, and get you set up with coverage long before you need to file a claim. But first, here’s a closer look at cotton farm insurance.

What Is Cotton Farm Insurance?

Boiled down, cotton farm insurance is basically a contract between an insurance company and the insured in which the carrier agrees to cover certain losses that befall the business. Cotton farm insurance is just one special type of Tennessee farm insurance. The basics of Tennessee business insurance are included, such as property and revenue protection. A Tennessee independent insurance agent can help you find a policy that works for you.

What Are Some Common Risks to My Cotton Farm?

Businesses of any kind are subject to threats on a daily basis. A few of the most common that could befall your cotton farm include:

- Lost income: Without coverage, your cotton farm’s income could take a serious hit from just one disaster, whether it’s a fire, storm, or something else.

- Property damage: Without the proper coverage, your cotton farm’s commercial property, like barns, etc., could be expensive to replace after a peril like vandalism.

- Lawsuits: Again, without the right coverage, a lawsuit could be devastating to have to pay for out of pocket.

Reviewing common risks to your cotton farm can greatly help you in your search for the right coverage. A Tennessee independent insurance agent can help even further.

What Does Cotton Farm Insurance Cover in Tennessee?

According to insurance expert Paul Martin, your cotton farm insurance policy may vary, but there are a few core coverages you can typically expect to find, like:

- Equipment insurance: Covers your cotton farm’s equipment, including tools and machinery, against many threats, like lightning damage.

- Liability insurance: Covers you in the event of a lawsuit so you don’t have to pay out of pocket for attorney and court fees.

- Property insurance: Covers your cotton farm’s property like barns, silos, fences, and more from many threats like storms and vandalism.

Working with a Tennessee independent insurance agent is a great way to create a cotton farm insurance policy that works best for you.

Cotton Farm Stats for the US

When you shop for cotton farm insurance, it’s helpful to know a bit about your industry first. Check out some stats for cotton farming in the US below.

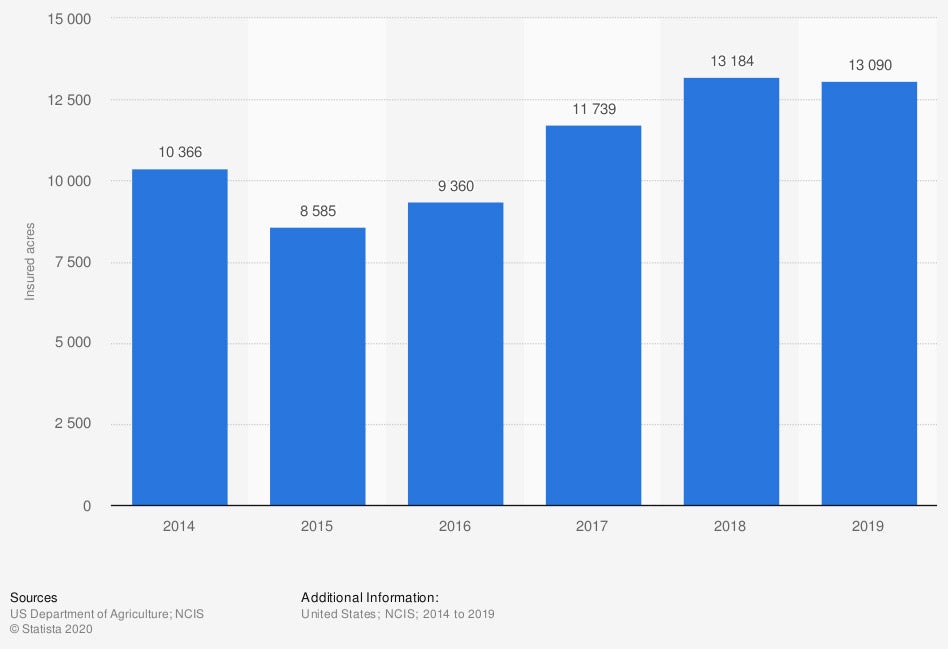

Volume of insured acres of upland cotton US, 2014-2019

The volume of insured acres of upland cotton has increased quite a bit since the middle of the last decade. As of 2014, about 10,366 acres of upland cotton were insured. By 2019, this number had grown to 13,090 acres.

With cotton farming continuing to grow over the years, it’s increasingly important to get your cotton farm set up with the proper coverage to protect your crops.

Are There Other Policies That Can Provide Additional Protection?

Yes, and you can probably expect to have to add on at least one extra policy or two to your cotton farm insurance package. According to Martin, these are a couple of the most commonly added coverages:

- Commercial auto insurance: Protects your cotton farm’s business vehicles against lawsuits, vandalism, storm damage, etc.

- Crop insurance: Protects your cotton and other crops against disasters like freezing, flood damage, etc.

- Workers’ comp: Protects your workers against injury, illness, and death on the job. Coverage is crucial to have, even if Tennessee doesn’t legally require it for your cotton farm.

Your Tennessee independent insurance agent will help you select the additional coverages that make the most sense for your cotton farm.

What’s Not Covered by Cotton Farm Insurance in Tennessee?

You’ll need to double-check your specific policy with your Tennessee independent insurance agent to be sure of its exclusions, but some of the most common are:

- Equipment wear and tear

- Nuclear fallout or war damage

- Routine maintenance costs

- Earthquake damage

- Flood damage

- Insect infestations

Your Tennessee independent insurance agent can help you add a separate flood insurance or earthquake insurance policy if you’re concerned about these threats in your area.

Here’s How a Tennessee Independent Insurance Agent Can Help

When it comes to protecting cotton farms against risks like theft, disease, fire, and all other perils, no one’s better equipped to help than an independent insurance agent. Tennessee independent insurance agents search through multiple carriers to find providers who specialize in cotton farm insurance, deliver quotes from a number of different sources, and help you walk through them all to find the best blend of coverage and cost.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

chart - https://www.statista.com/statistics/723042/volume-of-insured-acres-of-upland-cotton-usa/

https://www.iii.org/article/understanding-crop-insurance

https://www.iii.org/publications/insuring-your-business-small-business-owners-guide-to-insurance/insurance-for-specific-businesses/farms-and-ranches

© 2024, Consumer Agent Portal, LLC. All rights reserved.