For most businesses, equipment is a key component for efficiency and keeping the business up and running. For the 603,310 small businesses in Tennessee, adding commercial equipment insurance to their business insurance can help pay for repairs or breakdowns of equipment and machinery.

Whether you're looking to purchase business equipment insurance or are just figuring out what you need, a Tennessee independent insurance agent can help you get started.

What Is Commercial Equipment Insurance?

Commercial equipment insurance is a type of business insurance that helps pay to repair or replace broken or damaged machinery and equipment. Another name for this type of insurance is boiler and machinery coverage.

Whatever the industry, most businesses have equipment that helps it run. For a tech company it's a computer system, for a restaurant it's kitchen appliances, and for construction workers it's heavy machinery. If any of this equipment should breakdown, it could cost your company thousands or millions of dollars.

What Does Tennessee Business Equipment Insurance Cover?

According to independent insurance expert Jeffrey Green, equipment breakdown covers repairs and replacement of both the machinery and other property damaged as a result of the breakdown.

Equipment breakdown has different covered perils depending on the type of machinery, but common coverages include:

- Mechanical breakdowns

- Power surges

- Motor burnouts

- Short circuits

- Mandatory inspections

- Damage to someone else's property

- Stolen equipment

- Vandalized equipment

Should any of the above perils occur, your business equipment insurance will pay for repairs, lost income, labor and time for someone to make the repairs, and any loss or spoilage of goods.

What Doesn't Tennessee Business Equipment Insurance Cover?

Equipment breakdown insurance will cover many things, but there are some exclusions to be aware of. According to Green, the most common causes of loss that are not usually covered include:

- Computer viruses

- Leaking

- Negligence

- General wear and tear

Property that is not covered under equipment breakdown includes

- Aircraft

- Watercraft

- Computer media

- Vehicles

Green emphasized that there will also be other causes of loss and property named in the policy exclusions, so it's important to work with your Tennessee independent insurance agent to fully understand your policy.

Business equipment insurance also won't cover any lost income that is not directly related to the breakdown of the equipment. If you're looking for lost income coverage, you'll want to seek out a business interruption policy.

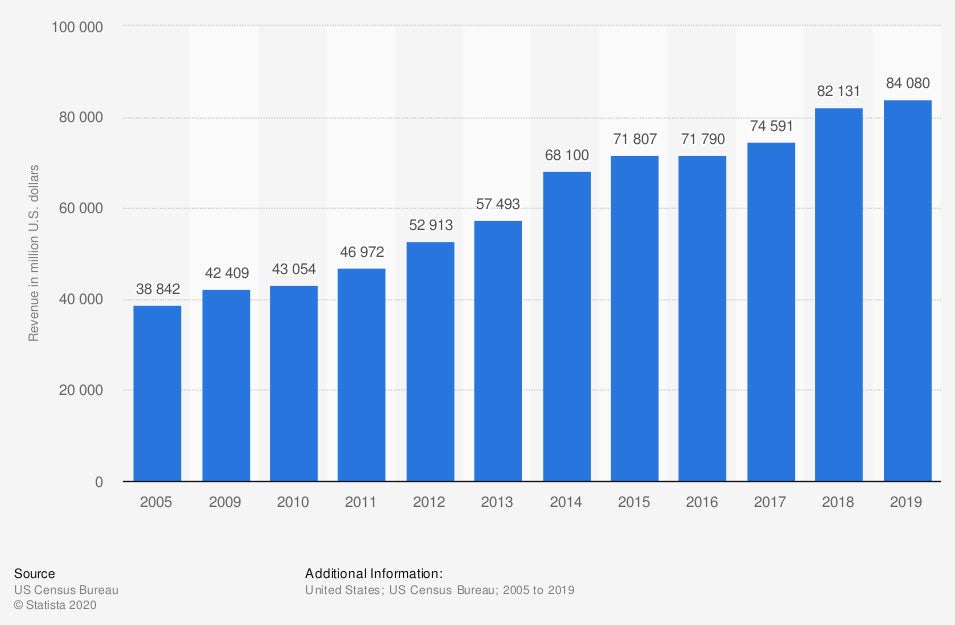

Commercial equipment rental revenue in the US (in million US dollars)

More businesses are renting commercial equipment every year. Whether you rent or lease your equipment, it's best to know what your insurance will cover.

What Is Commercial Equipment Warranty Insurance?

If you've ever purchased an appliance for your home, you've most likely been offered a warranty. Commercial equipment warranties are similar and may come as an included or added option when purchasing equipment.

Warranties may provide similar coverage to a commercial equipment insurance plan, but there are some things to keep in mind.

- Time limit: Most warranties are only good for a certain number of years. Any damage outside of the warranty time limit will have to be paid out of pocket.

- Exclusions: Operator error is not covered under a warranty, but is covered under a commercial equipment policy.

- No reimbursements: On some commercial equipment policies, you'll get reimbursed for any lost income directly related to the broken equipment. Warranties never cover lost income.

An equipment warranty can still leave you highly exposed to big repair or replacement bills. Your Tennessee independent insurance agent can help you compare warranty coverage to business equipment coverage.

Do You Need Business Office Equipment Insurance in Tennessee?

Sometimes business office equipment doesn't have high enough value or risk for a business equipment insurance policy. In these cases, a Tennessee commercial property policy could provide the coverage you need.

If you run your business out of your home, keep in mind that your homeowners policy will not provide coverage for office equipment. The best solution is to add equipment insurance as an add-on to your policy to make sure you're covered.

Talk to an Independent Insurance Agent in Tennessee Today

Equipment is a crucial part of most businesses. If your equipment fails, your business suffers and it's important to get back on your feet as quickly as possible. Business equipment insurance helps you do just that.

Working with a Tennessee independent insurance agent is the easiest and most efficient way to find the best coverage for your equipment. They'll shop multiple carriers and provide you with a handful of quotes. They'll advise you from beginning to end and make sure your business is protected from top to bottom.

Author | Sara East

Article Reviewed by | Jeffery Green

https://advocacy.sba.gov/2019/04/24/2019-small-business-profiles-for-the-states-and-territories/

https://www.tn.gov/ecd/small-business/bero/bero-dashboards.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.