In Tennessee, there are 603,310 small businesses in operation. When you own a company, you have to account for all the what-ifs. Tennessee business insurance can have sufficient protection for your barbershop.

A Tennessee independent insurance agent will have access to multiple markets so that you get the best options on policy and price. They do the shopping for you at no additional cost. Connect with a local expert for coverage questions.

What Is Barbershop Insurance?

Your barbershop policies should cover your risks as a business owner in Tennessee. You'll want liability, property, and employee coverage to help protect your livelihood.

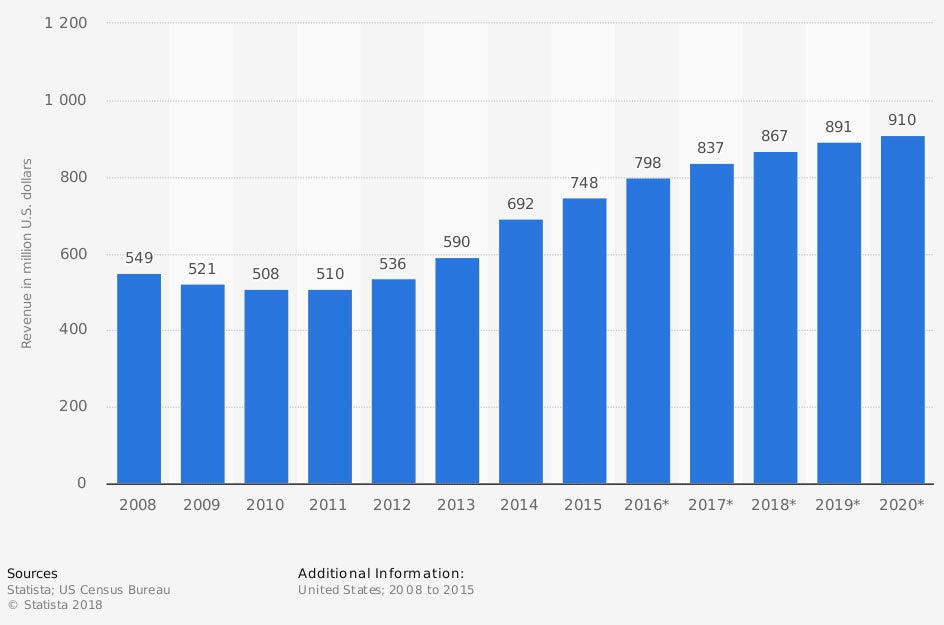

Revenue of barbershops in the US (in million US dollars)

Barbershops are a growing industry everywhere, and competition can be fierce. To have enough coverage for your business, you'll want to know how insurance works.

What Does Barbershop Insurance Cover in Tennessee?

In Tennessee, $6,317,565,000 in commercial insurance claims were paid in 2019 alone. Every policy you own will have a purpose, and some are more standard than others. Check out these barbershop insurance options that you will want to look at:

- General liability insurance: Pays for claims of bodily injury or property damage where you and your employees are responsible.

- Business interruption: This will pay for regular business expenses when you are temporarily shut down due to a covered loss.

- Commercial property insurance: Pays for damage to your building, equipment, and inventory caused by a covered loss.

- Crime insurance: Pays for a claim involving forgery, fraud, or theft to your company.

- Workers' compensation insurance: Pays for an employee's medical expenses resulting from an injury or illness on the job.

- Errors and omissions insurance: Pays for lawsuits by clients for negligence, personal injury, and consulting.

How Much Is Barbershop Insurance in Tennessee?

The cost of your commercial insurance policies will be specific to your operation. Carriers look at numerous items when calculating premiums. Check out the risk factors insurance companies use when rating your barbershop insurance in TN:

- Type of operation you run

- Prior claims reported

- Number of years in the industry

- If you have employees

- If you have safety practices

- The value of property owned

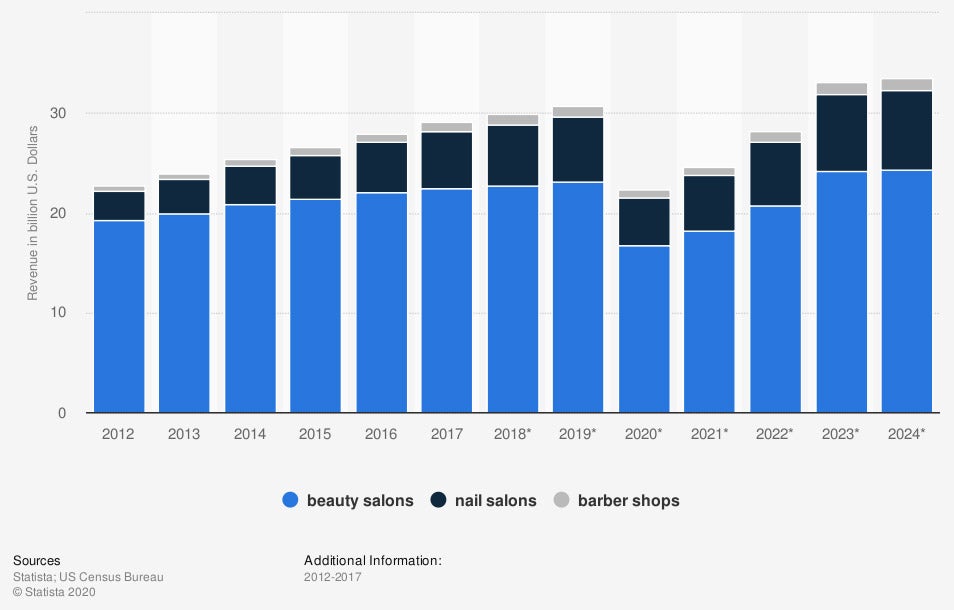

Industry revenue of haircare and esthetic services in the US (in billion US dollars)

The Tennessee haircare industry is large and could be a viable choice for a business. Your barbershop will be a part of that number.

Will My Tennessee Location Impact My Rates?

Where you choose to place your Tennessee barbershop will have an impact on what you pay for insurance. Carriers look at the safety of your location to determine your costs. Take a look at what could play a role in your rates based on the territory:

- Local crime rate

- Local natural disasters reported

- Local claims reported by other insureds

- Flood zone assigned

How an Independent Insurance Agent Can Help in Tennessee

If you're looking for the best commercial insurance in Tennessee, a licensed professional can help. You'll have several coverage options to choose from, and knowing what applies can be challenging. Fortunately, a trusted adviser will review your policies for free.

A Tennessee independent insurance agent will have access to multiple markets so that you have choices. They do the shopping for you, saving time and premium dollars. Connect with a local expert on TrustedChoice to get started today.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/forecasts/409860/united-states-barber-shops-revenue-forecast-naics-812111

Graphic #2: https://www.statista.com/forecasts/1014390/hair-care-and-esthetic-services-revenue-in-the-us

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.