Insurance Content Navigation

- Best Farm Insurance Companies in Tennessee

- Best Farm Insurance Company Near Me

- What Do the Best Farm Insurance Companies Offer in Tennessee?

- How Much Does Farm Insurance Cost in Tennessee?

- When Is the Best Time to Buy Farm Insurance in Tennessee?

- Farm Insurance Statistics

- How a Tennessee Independent Insurance Agent Can Help You

Best Farm Insurance Companies in Tennessee

When you're searching for the best farm insurance in Tennessee, it can be confusing. What's right for your farm may not be suitable for someone else's farm. However, you can determine which carriers are most used by your peers and who they trust.

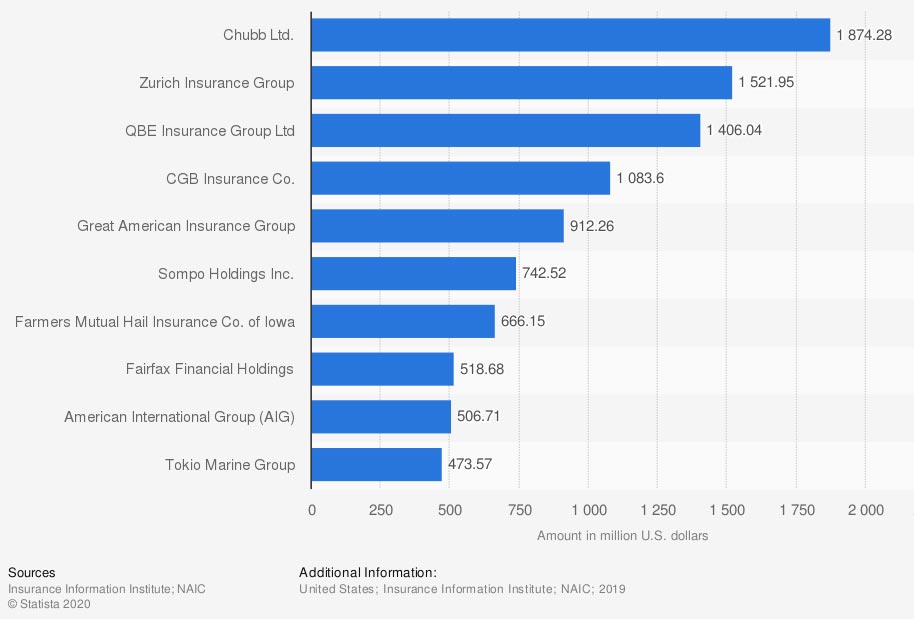

Largest multiple peril crop insurance companies in the US, by direct premiums written (in million US dollars)

Even if a carrier is popular, it doesn't necessarily mean it's the best. Discuss your options with a trained professional to find what fits your needs and budget.

Best Farm Insurance Company Near Me

The leading farm insurance companies near you in Tennessee will vary depending on where you live in the state. However, for the most part, the same carriers will be countrywide or at least statewide, and the best is relative. Your operations will determine which company works for your farm.

Check out the top property and casualty insurance carriers in the US:

- Nationwide

- Farmers Insurance Exchange

- Auto-Owners Insurance

- Erie Insurance

- Sentry Insurance Group

What Do the Best Farm Insurance Companies Offer in Tennessee?

In Tennessee, your farm insurance policies will vary depending on your operations. When it comes to coverage, you'll have options, but basic policies will apply to most farms. Take a look at standard coverages to consider for your farm:

- Liability: A general liability policy will provide bodily injury and property damage coverage.

- Commercial property: This policy covers your farm structures and pole barns, and can even insure your equipment.

- Accidents: This can be anything from coverage for electrocution, fire and smoke, to loading and unloading of livestock.

- Natural disasters: Volcanic eruptions and sinkholes are covered. Typically floods and earthquakes are covered under separate policies.

- Weather events: Lightning, wind, hail, tornadoes, and more.

- Crimes and civil unrest: This is for your theft and vandalism of livestock.

- Crops: There are a couple of different crop policies you can obtain. All will cover various types of damage to your crops and reimburse if necessary.

How Much Does Farm Insurance Cost in Tennessee?

Insurance companies will calculate your premiums using your individual risk factors. This means the cost of each policy will be different for every Tennessee farm. Your exact pricing can only be determined by obtaining quotes. Check out what goes into your costs:

- Prior losses

- Value of farm equipment and property

- Value of crops

- Your age and experience

- Length of time with the previous carrier

- Local crime rate

When Is the Best Time to Buy Farm Insurance in Tennessee?

The minute you purchase a farm property, you'll need coverage. The right protection for your farmhouse, acreage, equipment, crops, and livestock is necessary from the get-go. To get started, your adviser will need to know the answers to some of these questions:

- Your herd's specifics: You'll need to cover the risks that are specific to your herd. Horses will have different needs from cattle and so on.

- What your livestock is worth: This is the value you can get in the marketplace for your livestock. You are covering the risk for replacement cost if something happened to them.

- If you have crops: If your farm deals with planting and producing crops, you'll need separate crop insurance.

- Other structures and buildings: If you have a home, pole barns, and more on your property, you'll need coverage for the buildings themselves.

- What preemptive protection you have in place: Carriers will want to know how you are proactive, including if you are accounting for the risk of predators by having fencing and more.

Farm Insurance Statistics

In Tennessee, farms are pretty common through the rolling hills. There are numerous farms and acreage that make this state a beautiful place to call home. Check out some farm facts:

- Value of private crop-hail insurance in Tennessee: $58,500,000

- Crop-hail loss ratio in Tennessee: 114.00%

- Number of organic farms in the US: 14,367

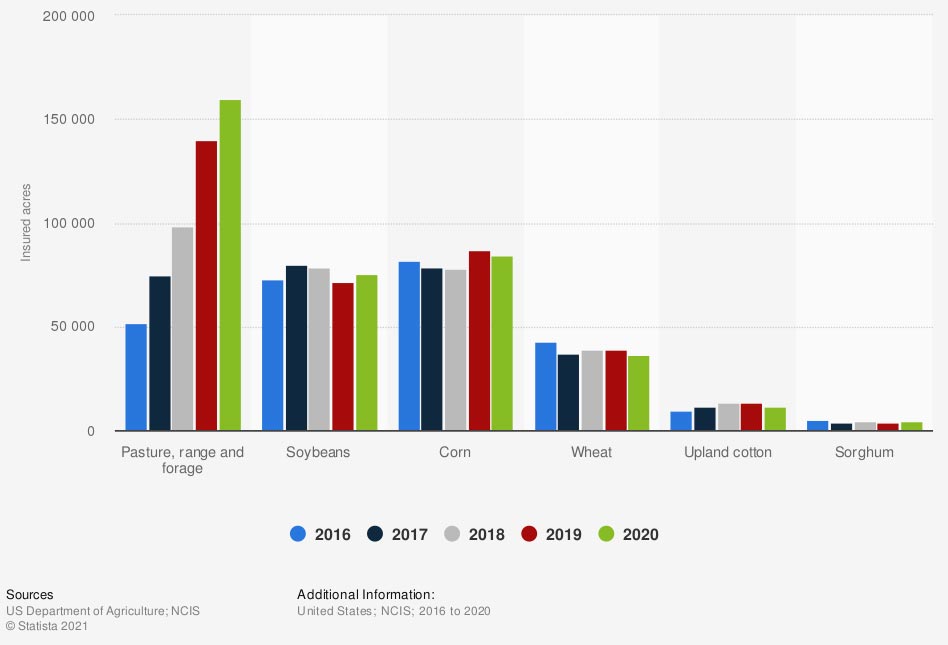

- Volume of insured farmland in the US by acres: 140,210 pasture, range, and forage

Volume of insured acres of farmland in the US in recent years, by crop

No matter where you live in the US, farms are everywhere. If you are part of America's heartland, then you'll need proper protection for all the what-ifs.

How a Tennessee Independent Insurance Agent Can Help You

With all the companies and coverages out on the market, it can be challenging to know what's necessary. There are several risk factors you have to account for when you own a farm. Fortunately, you're not alone, and a trusted adviser can help for free.

A Tennessee independent insurance agent works with multiple carriers at once so that you have options on policy and premium. They'll even do the shopping for you at no additional cost, making it super-easy. Connect with a local expert on trustedchoice.com to get started in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/689397/largest-mpci-companies-usa-by-direct-premiums/

https://www.statista.com/statistics/723015/volume-of-insured-acres-of-farmland-usa-by-crop/

https://www.statista.com/statistics/185365/revenue-of-leading-mutual-property-casualty-insurance-companies/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.