A new house is a huge achievement, and one you're rightfully proud of. But sadly, even newly constructed homes can go up in flames. So what happens if there's an electric fire in your brand-new house?

A Tennessee independent insurance agent can help you get protected against this disaster and others with the right homeowners insurance. You'll get the coverage you need to feel safe long before catastrophe strikes. First, though, here's an examination of who's responsible in this specific scenario.

Top Causes of Electrical Fires in Tennessee Homes

It's important to know all the ways in which an electrical fire can start in your home. Here are just a few of the most common.

Electrical house fires are most commonly caused by:

- Aging appliances and outlets: Old cords that show visible signs of wear are especially dangerous, as are malfunctioning outlets that give off heat.

- Improper use of plugs: Plugs for larger appliances come with the third prong because they're designed for outlets that can compensate for the higher voltage required, and should never be jammed into the wrong outlet.

- Overloaded lights: The use of a bulb that has a wattage surpassing the lamp or other lighting fixture's recommendations can easily cause an electrical fire.

- Improper flammable material storage: Keeping flammable materials next to elements that heat up, especially light fixtures, or those that are even left on top of lights, can quickly cause fires.

- Overuse of extension cords: Certain things like large appliances just aren't designed to be plugged into extension cords because of the risk of fire.

- Space heater use: Keeping space heaters too close to flammable elements like clothing, stacks of paper, curtains, etc. is another top cause of electrical fires in homes.

Keep these top causes of electrical fires in mind when inspecting and maintaining your home for your best chance at avoiding disaster.

In Tennessee, Who’s Responsible If There’s an Electric Fire in My New House?

Make sure to always ask for a property inspection before you sign the contract on a new house. Though an electrical fire could very well be the fault of the new home's electrician or builder, you as the homeowner would still have to go through your insurance for the incident. Your homeowners insurance company would most likely end up suing the builder or electrician to recoup the losses, but it's still your responsibility to file the claim.

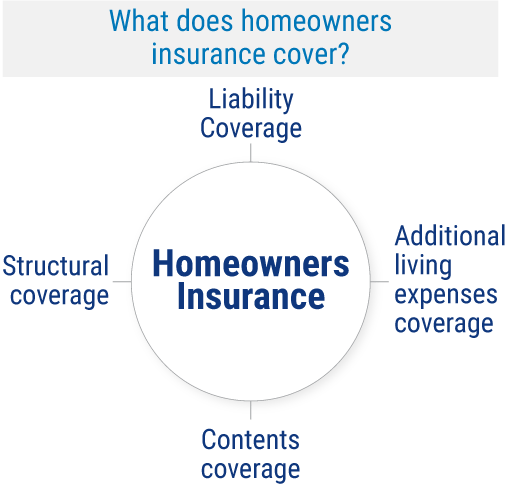

What Does Homeowners Insurance Cover in Tennessee?

Standard homeowners insurance in Tennessee provides a lot of critical protection, like:

- Liability coverage: Your policy includes protection against lawsuits filed against you by others for claims of property damage or bodily injury.

- Additional living expenses coverage: Your policy includes protection for hotel costs, takeout meals, and more if you're forced to live somewhere else while your home is undergoing repairs after a covered incident.

- Contents coverage: Your policy includes protection for your physical belongings like collections, silverware, etc. against threats like fire, theft, and more.

- Structural coverage: Your policy also protects your home's structure against many threats like vandalism, falling objects, car crashes, and more.

A Tennessee independent insurance agent will make sure that you walk away with a homeowners insurance policy that provides all the right coverage.

Do I Have to Pay for the Electrical Fire Damage to My Home, Myself?

You'd have to pay for the cost of your home insurance's deductible out of your own pocket before the coverage would kick in and reimburse you for the rest. Afterwards, you'd be covered up to your policy's limits in the structural and contents coverage categories. It's important to work with a Tennessee independent insurance agent to get equipped with a home insurance policy with the right deductible amount and coverage limits for your needs.

Will My Tennessee Home Insurance Rates Go Up Even If I'm Not Responsible for the Damage?

The good news is that your home insurance rates are unlikely to increase after just one incident, according to insurance expert Paul Martin. Home insurance companies factor in whether the incident was your fault, as well as how frequently you file a certain type of claim. For just one incident such as a singular electrical fire, they're highly unlikely to punish you with more expensive premium rates.

What Doesn't Homeowners Insurance Cover in Tennessee?

Your Tennessee homeowners insurance can protect you against many unforeseen catastrophes, including an electric fire in your new house. But there are certain things it can't cover or reimburse you for, like:

- Homeowner negligence or failure to maintain the home

- Flood damage and earthquake damage

- Intentional and malicious acts towards others

- Damage from war or nuclear fallout

- Damage from insect infestations

- Routine maintenance costs

If you live in an area prone to disasters that can cause flooding, which is common in Tennessee, you should talk to your independent insurance agent about getting separate flood insurance. Likewise, if you're in an area that gets hit by frequent earthquakes, it's a good idea to look into adding earthquake insurance.

Why Choose a Tennessee Independent Insurance Agent?

It’s simple. Tennessee independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

Tennessee independent insurance agents also have access to multiple insurance companies, ultimately finding you the best homeowners insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

4abc.com/blog/the-7-most-common-causes-of-electrical-fires-in-the-home

iii.org/article/homeowners-insurance-basics

© 2024, Consumer Agent Portal, LLC. All rights reserved.