Life insurance provides financial support for your loved ones in the event of your unexpected or untimely death.

When you die, your loved ones are left with the financial responsibility for your funeral and death-related expenses, as well as continuing on without any income you were providing. That's why working with a Tennessee independent insurance agent is the perfect way to make sure your family is protected long after you're gone.

What Is Life Insurance?

Life insurance is the only type of insurance policy that you purchase for someone else. While you're alive, you enter into a contract with an insurance carrier where you pay a monthly premium in exchange for a death benefit amount to be paid to a person you choose, called a beneficiary.

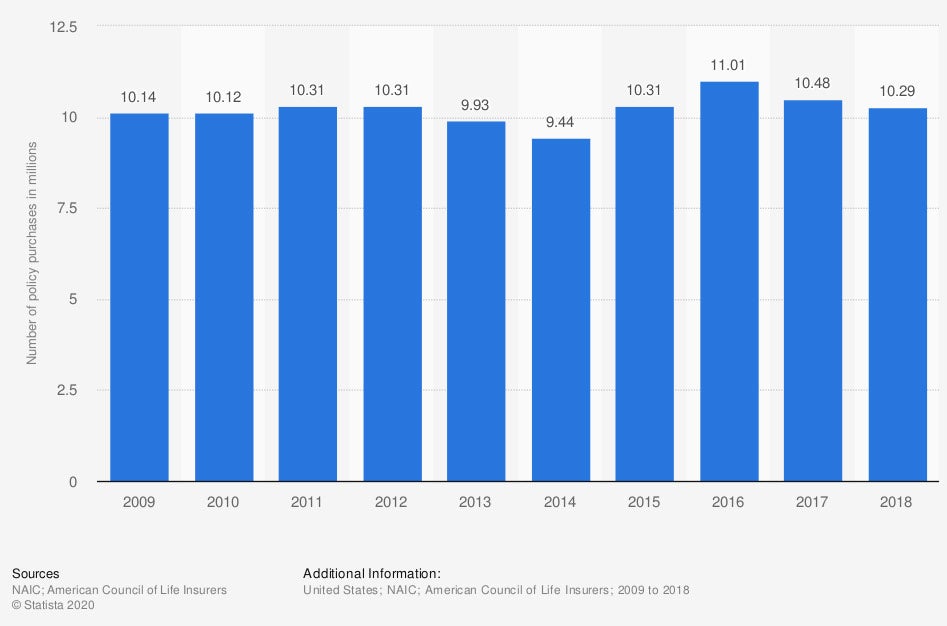

Number of individual life insurance policy purchases in the US from 2009 to 2018 (in millions)

In 2018, about 10.3 million individual life insurance policies were purchased in the United States.

According to independent insurance agent, Paul Martin, it's a good idea to purchase life insurance if the loss of your ability to earn income would negatively impact someone else.

"Even if you don't have a family, if you were to pass away, someone would have to take care of your final expenses," said Martin. "Life insurance can pay off property or auto loans, liens, and burial expenses."

What Does Tennessee Life Insurance Cover?

Life insurance is unique in that your beneficiary will not be limited as to what they can use the death benefit for. It can be used to pay for any income replacement or financial need, but the most common uses include:

- Burial costs

- Funeral costs

- Lost income

- Childcare

- Tuition

- Co-signed debt

- Monthly bills

"When selecting a life insurance amount, it's important to map out your potential expenses if you should pass away," explained Martin. "I recommend carrying enough insurance to pay off any personal debt and mortgages, and replace necessary lost income."

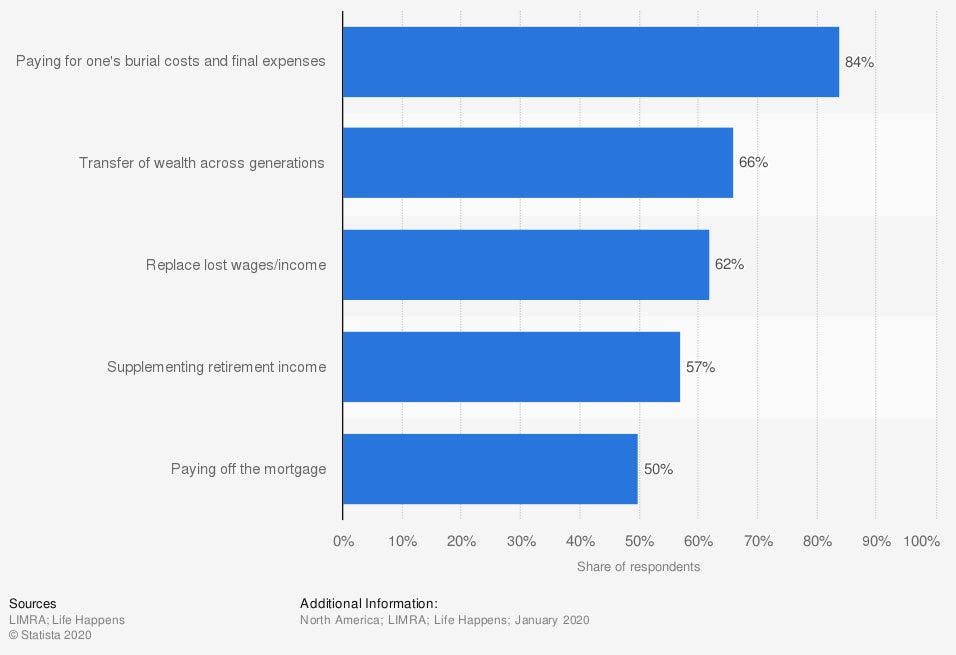

Leading reasons for owning life insurance in the United States in 2020

84% of Americans own life insurance to assist their families with paying for burial-related costs when they die.

What Doesn't Tennessee Life Insurance Cover?

There are rare occasions where your life insurance policy may not pay out to your beneficiary in the event of your death. These scenarios are rare but important to know.

- If you've lapsed on your payment or let your policy expire: Some life insurance policies are on a term basis, meaning you have to renew when the term is up. If you fail to pay your monthly premiums or renew your policy, your beneficiary will not receive a payout.

- If your death is the result of fraudulent or illegal activity: If your death is directly related to an illegal or fraudulent activity, like robbing a store, your carrier will most likely not pay out the benefits.

- If the death is suicide within a certain time frame: Life insurance carriers do not want to incentivize anyone to harm themselves, so most carriers have a suicide clause that states that the benefits will not pay out if the insured dies by suicide within two years of purchasing the plan.

Your Tennessee independent insurance agent can help you better understand what is and is not covered under your life insurance policy.

What Is Whole vs. Term vs. Universal Life Insurance?

Insurance carriers provide multiple options for life insurance policies. The most common are whole, term, and universal policies. Each offers different benefits and has its own pros and cons.

- Term life insurance: Covers you for a specific "term" or period of time. Typical term options are 10, 20, or 30 years. If you die within the designated term of your policy, your beneficiary receives a payout. Term policies tend to be the most affordable and attractive to young individuals and new families.

- Whole life insurance: Also referred to as "permanent" life insurance, whole life insurance covers you for the entirety of your life. It includes a savings account component that can be used while you're alive through withdrawal or being borrowed against.

- Universal life insurance: Similar to whole life insurance in that it is meant to last your entire life and includes a savings account aspect. However, it also accrues interest and you can put in more money than your payment in order to take advantage of the interest. You can also adjust your death benefit and the premium of your universal policy.

With life insurance policies that include a cash account, when you die, the cash value of the account will be absorbed by the insurance company unless a policy rider is purchased that says your beneficiary can receive the cash.

Where Can I Purchase Life Insurance in Tennessee?

In Tennessee, more than $66 billion in life insurance purchases are made every year. Most insurance companies carry life insurance, but some carriers write more policies than others.

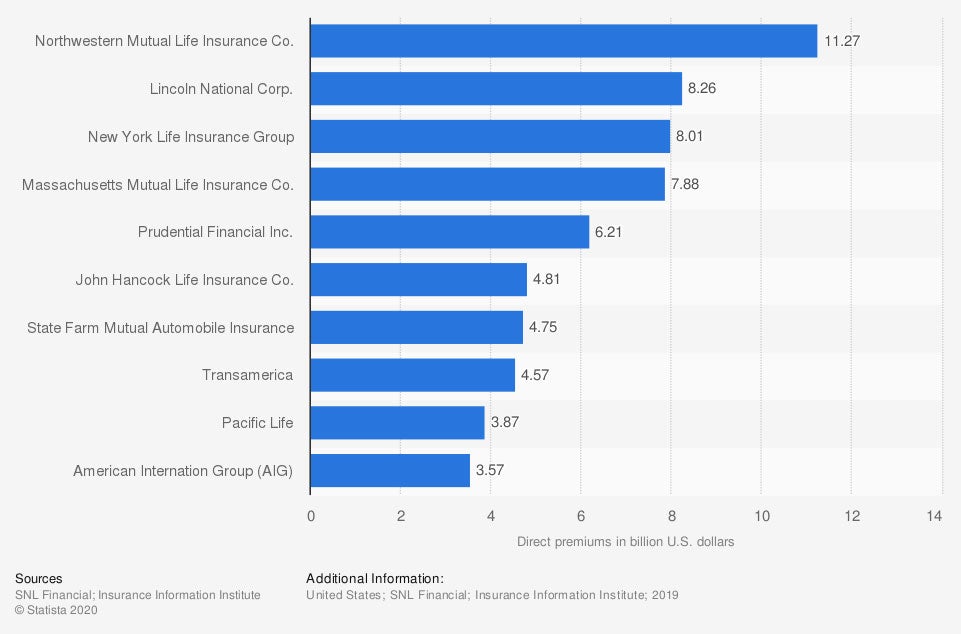

Leading writers of individual life insurance in the US in 2019, by direct premiums written (in billion US dollars)

Northwestern Mutual Life Insurance Co. was the largest individual life insurance writing company in 2019, with $11.3 billion dollars in direct premiums written.

When your insurance agent provides you with policy quotes, they'll offer a variety of carriers for you to choose from.

How a Tennessee Independent Insurance Agent Can Help

The best way to find life insurance in Tennessee is to work with an independent insurance agent. In the United States, independent agents distribute 53% of life insurance policies.

Tennessee independent insurance agents are experts in life insurance and can help you choose between permanent and term plans, pick your death benefit amount, and understand how to get the most out of your policy for yourself and your family.

Author | Sara East

Article Reviewed by | Paul Martin

https://www.statista.com/statistics/374992/life-insurance-purchases-in-the-us-by-states/

https://www.iii.org/insurance-basics/life-insurance/shopping-for-insurance-1

https://www.iii.org/insurance-topics/life-insurance

© 2024, Consumer Agent Portal, LLC. All rights reserved.