Livestock is an essential source of income for farmers and should be insured correctly. If you own a horse farm, there are specific policies you'll need to consider for proper coverage. Tennessee business insurance can help protect your assets and livelihood.

A Tennessee independent insurance agent is a knowledgeable resource when finding a policy that fits your budget and needs. They have access to several markets so that you have options. Connect with a local expert for custom quotes in minutes.

What Does Horse Farm Insurance Cover in Tennessee?

Your Tennessee horse farm insurance can cover a variety of items. If you have a general knowledge of what could be included in your farm policy, you can ensure proper protection.

What your horse farm insurance generally covers:

- Accidents: This can be anything from coverage for electrocution, fire, smoke, to loading and unloading of livestock.

- Natural disasters: Volcanic eruptions and sinkholes are covered. Typically, floods and earthquakes are covered under a separate policy.

- Weather events: Lightning, wind, hail, tornadoes, and more.

- Crimes and civil unrest: This is for theft and vandalism of livestock.

What Doesn't Horse Farm Insurance Cover in Tennessee?

Your Tennessee horse farm will have several exposures, and not all will fit under your policies. It's key to know what your insurance might not cover.

Coverage that could be added but does not come standard on your policy:

- Accidental shooting

- Drowning

- Attacks by wild animals

- The collapse of a building on livestock

What your horse farm insurance will exclude:

- Old age

- Death by natural causes

- Disease

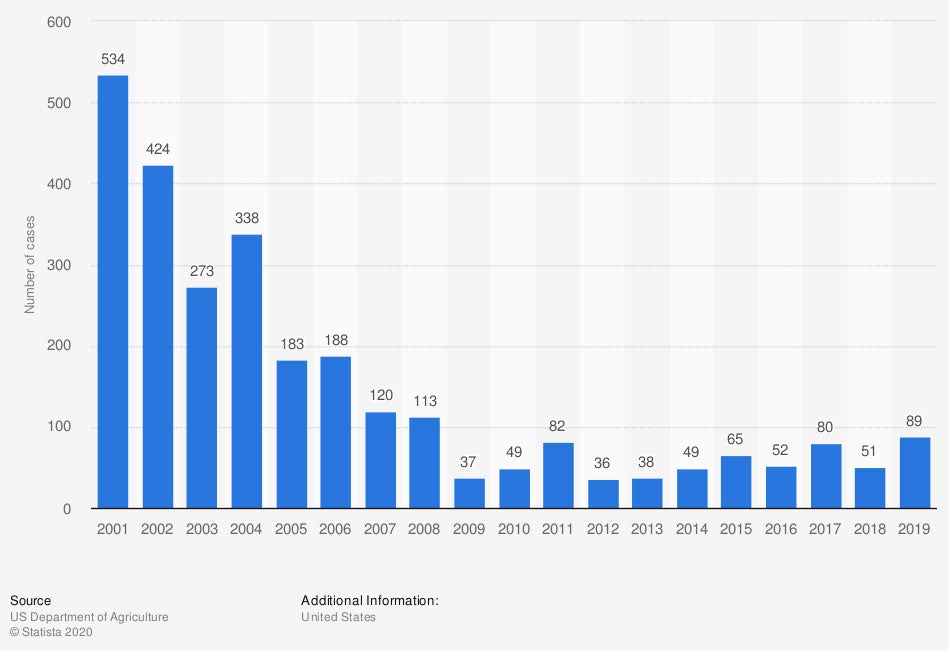

Disease can be crippling if it hits your livestock. Take a look at the numbers below as it pertains to horses:

Equine infectious anemia cases in the US

Now that you know what's not covered under your basic horse farm policies, you should be aware of how much is covered. Your livestock insurance could be handled a few different ways.

How Much Livestock Is Covered under Horse Farm Insurance in Tennessee?

Your farm will need to have a secure footing for its operations to avoid accidents or diseases that could befall your animals.

Some insurers may include a broader animal mortality policy that includes sickness and disease. There are three ways to cover your horses or other livestock:

- Individual coverage: This insurance usually covers higher-value animals on an individual basis. The animals are listed on the policy according to some identifying marker or description, such as an ear tag, and covered for a specific dollar amount.

- Blanket coverage: This type of policy allows you to insure all your farm property for a predetermined value. It includes structures, equipment, tools, and livestock.

- Herd Coverage: This is the simplest and most prevalent type of insurance for livestock. This coverage allows you to insure a specific number of animals.

Common Risks on a Tennessee Horse Farm

In order to operate a successful, functioning business, you'll need your horses healthy and undisturbed. It's good practice to know how your horse farm insurance works and what risks you are protecting against.

Risk factors your agent needs to know:

- Your herd's specifics: You'll need to cover the risks that are specific to your herd. Horses will have different needs than cattle, and so on.

- What your livestock is worth: This is the value you can get in the marketplace for your livestock. You are covering the risk of the replacement cost if something happened to them.

- What preemptive protection you have in place: Carriers will want to know how you are proactive, such as if you are accounting for the risk of predators by having fencing, and more.

Additional Coverage for your Tennessee Horse Farm

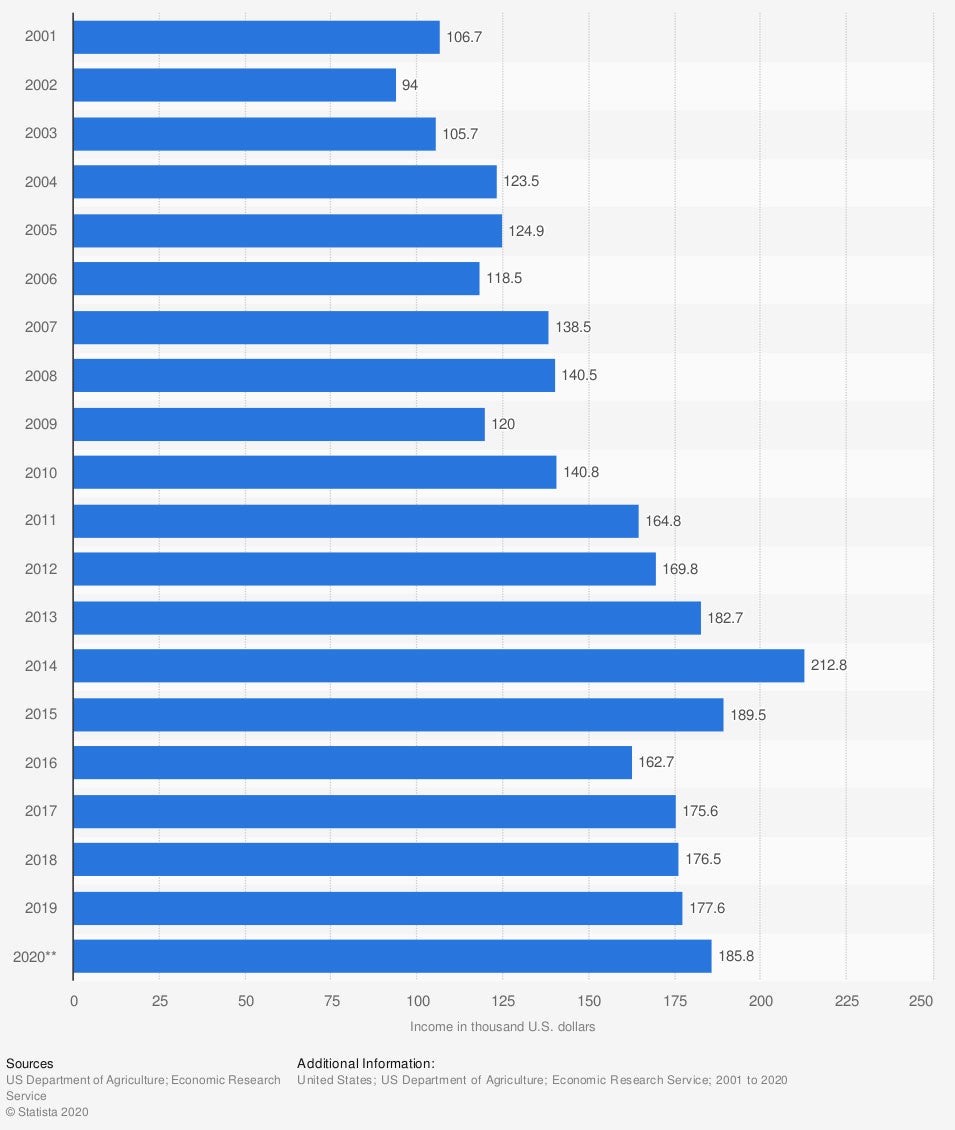

Suppose you're found to be responsible for your animals causing bodily injury or property damage to other people or their property. In that case, you'll have coverage under the liability portion of your livestock policy. Farmers can pull in a lot of additional funds when they have livestock or products for sale. Check out the numbers below:

US farm income from livestock and products

(in 1,000 US dollars)

Insurance for your farm may need to be expanded when you have extra items that need protecting. Take a look at some additional coverage options for your horse farm in Tennessee:

- Commercial umbrella insurance: This policy can be obtained for additional liability coverage above and beyond your underlying limits.

- Inland marine insurance for farm equipment: This can be added to any farm policy that uses equipment, tractors, and more for tending to their farm.

- Extended liability limits: You can increase your underlying liability limits for added coverage.

How a Tennessee Independent Insurance Agent Can Help

Your Tennessee horse farm needs proper protection for all the what-ifs. There are several moving parts for livestock, and you'll want the right policies in place to avoid financial ruin. Horse farm insurance can be obtained through a trusted adviser.

Fortunately, a Tennessee independent insurance agent can help you find a policy for an affordable price. They do the shopping for you at no additional cost. Get connected with a local expert on TrustedChoice in minutes.

Article Author | Candace Jenkins

Graphic #1: https://www.statista.com/statistics/1024599/equine-infectious-anemia-cases-us/

Graphic #2: https://www.statista.com/statistics/196415/us-farm-income-from-livestock-and-products-since-2001/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.