Equipment breakdowns can lead to a costly repair bill and even cause a business to have to close its doors. Closed doors mean no revenue flowing in, which is why it's critical for Tennessee business owners to look into equipment breakdown insurance.

If you're ready to protect your business's equipment, look no further than a Tennessee independent insurance agent. They can help you understand and find the right insurance for your business. To start, here's some more information about what this coverage can provide.

What Is Equipment Breakdown Insurance?

Equipment breakdown insurance, also referred to as boiler and machinery insurance, is a type of business insurance that pays for any physical damage or financial loss that occurs as a result of your business equipment breaking down.

The type of equipment and machinery that is covered typically falls into one of five categories: mechanical, electrical, computers and communications, air conditioners and refrigeration systems, and boilers and pressure equipment.

What Does Equipment Breakdown Insurance Cover?

For Tennessee businesses, equipment breakdown insurance covers mechanical or electrical breakdowns of machinery, tools, appliances, electronic devices, and systems such as furnaces.

The following events are covered under this type of insurance:

- Power surges

- Improper installation

- Pressure system breakdowns

- Mechanical breakdowns

- Short circuits

- Motor burnouts

Your insurance will not only pay for repair and replacement costs, but will also cover lost business income, time and labor, and even spoilage costs.

What Doesn't Equipment Breakdown Insurance Cover?

While most breakdowns will be covered by your insurance, there are occasional scenarios where equipment breakdown insurance will not cover the claim. This includes claims related to:

- Wear and tear

- Deterioration

- Mold

- Rot

- Pest damage

- Broken machinery as a result of age

According to insurance expert Paul Martin, "Property insurance generally has an exclusion for mechanical breakdown and electrical injury. Equipment breakdown insurance covers this and other unexpected and accidental events."

What Does Equipment Breakdown Insurance Cost in Tennessee?

Tennessee is home to more than 600,000 small businesses, and every business is different. Putting a single price on equipment breakdown insurance would not accurately reflect all businesses. Your Tennessee independent insurance agent can provide you with a more accurate quote, but cost will vary depending on the type of equipment you have.

A small business that is only insuring a couple of computers will pay much less than a construction company that needs all of their equipment insured. "Equipment breakdown insurance can range anywhere from $25 per year for $50,000 in coverage to several thousand dollars for a business with millions of dollars worth of machinery," explained Martin.

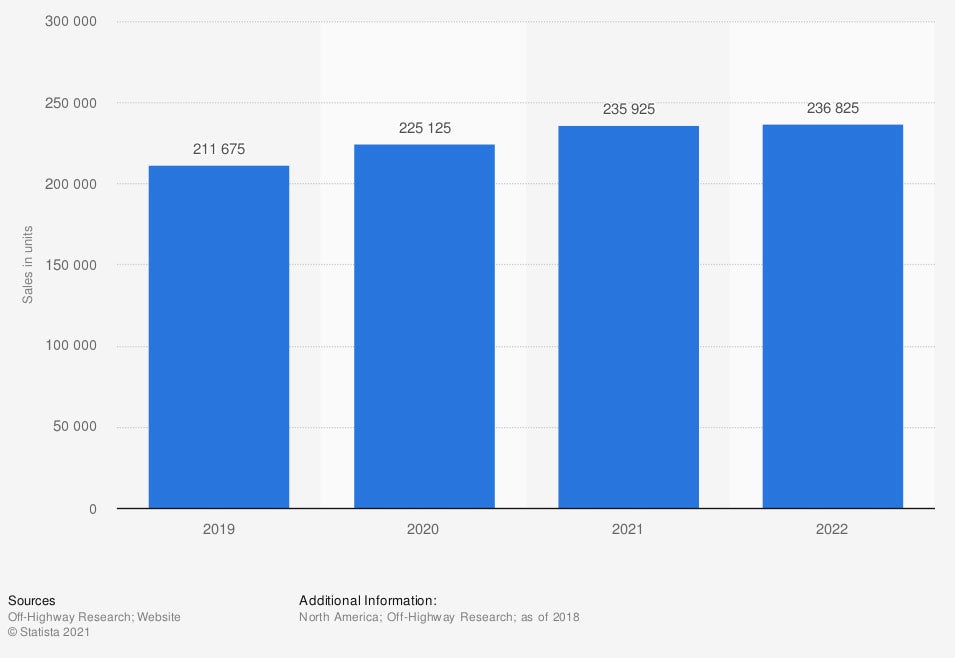

Projected construction equipment unit sales in North America from 2019 to 2022

North American sales of construction equipment are expected to reach about 236,825 units by 2022. North America is one of the largest target markets for construction equipment worldwide.

Is Equipment Breakdown Insurance Included in Your Tennessee Home Insurance?

Equipment breakdown insurance is not just for business owners. Homeowners can actually benefit from the coverage as well. What if your furnace or appliance were to break down and you didn't have a warranty? This could mean a costly repair bill.

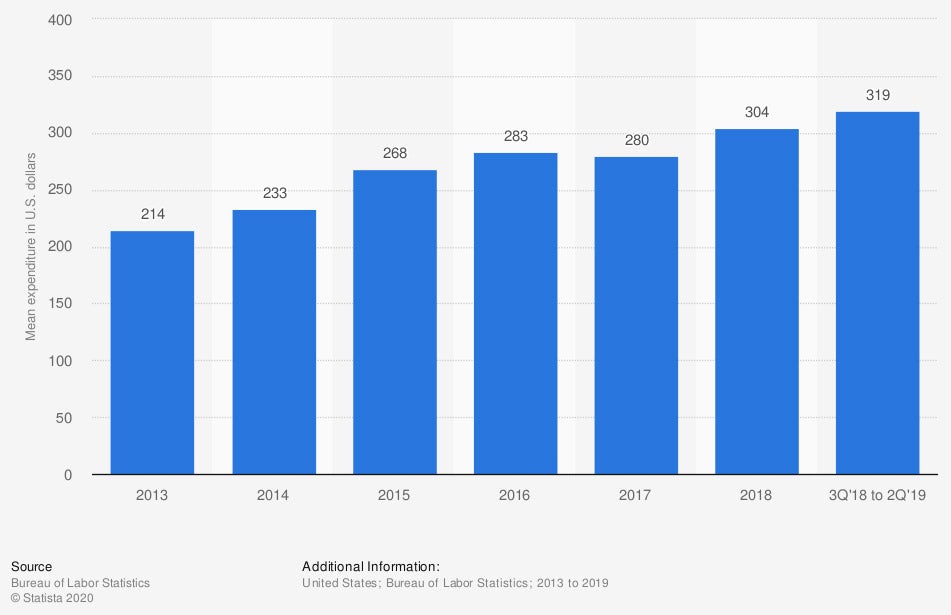

Mean annual expenditure of households in the United States on major appliances from 2013 to 2019 (in US dollars)

The average annual expenditure on major household appliances in the US grew from $214 in 2013 to $319 in the 12-month period from the third quarter of 2018 to the second quarter of 2019.

Unfortunately, the coverage and benefits you receive in an equipment breakdown policy are not included in a standard home insurance policy. Furthermore, mechanical and electrical breakdowns are excluded from home insurance, which is why equipment breakdown insurance is important to consider.

Equipment breakdown coverage is similar to a home warranty policy, which is offered when you purchase new appliances.

Martin suggested working with your independent insurance agent to compare the cost of a warranty policy to the cost of equipment breakdown coverage to determine which provides more thorough coverage for you.

How Can an Independent Insurance Agent Help?

Every business is different, which means every business needs a personalized equipment breakdown insurance policy. Tennessee independent insurance agents are experts in all things business insurance and know where to shop for the best rates and coverage.

Working with an independent insurance agent means you'll have support before, during, and after your purchase. If you have to file a claim, they'll even help you through that process. Work with an independent agent in Tennesee today.

Article Author | Sara East

Article Reviewed by | Paul Martin

Iii.org

https://www.bagleyandbagley.com/inland-marine-equipment-equipment-breakdown-insurance-com-gbn

https://advocacy.sba.gov/2019/04/24/2019-small-business-profiles-for-the-states-and-territories/

© 2024, Consumer Agent Portal, LLC. All rights reserved.