Tennessee has 603,310 small businesses in existence. When you operate a company, many things could be needed for accurate protection. Tennessee business insurance can sometimes include a business surety bond.

Fortunately, a Tennessee independent insurance agent can help with policy and rate options. They do the work for you at no additional cost. Get connected with a local expert for quote comparisons.

What Is a Surety Bond?

A Tennessee business surety bond is a contract between three parties: the principal, the surety, and the obligee. They are explained in further detail below:

- Principal: The person or entity obtaining the bond

- Surety: The insurance company supplying the bond

- Obligee: The person or entity requesting the bond.

The surety financially guarantees to an obligee on behalf of the principal. The principal will act according to the terms established in the bond. A surety bond can be used in a variety of situations.

What Does a Tennessee Surety Bond Cover?

It's key to understand why your Tennessee business could need a surety bond. Essentially, a surety bond exists to protect the obligee. Take a look at how it's broken down:

- Financial loss: Pays for financial loss if promised labor is not performed.

- Liability loss: Pays for liability in the event the work causes damage.

- Theft or fraud loss: Pays the obligee due to financial losses if one of your employees steals or commits fraudulent acts.

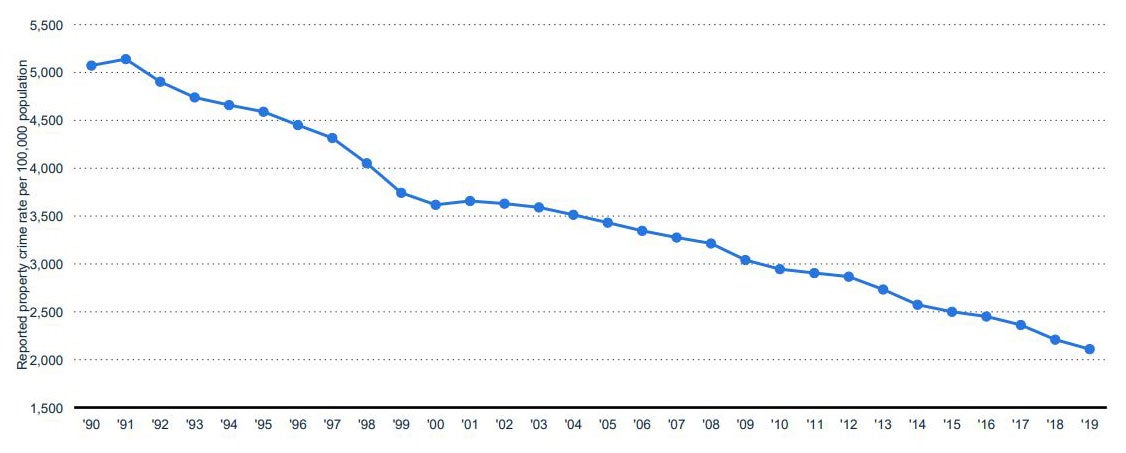

Property crimes in the US (per 100,000 population)

Many companies and government agencies will require that you have a surety bond before hiring you for a job. If a project is left incomplete or a loss occurs, this protects their interests.

How Much Does a Surety Bond Cost in Tennessee?

Similar to your other policies, like commercial auto coverage or workers' compensation, costs vary. Business surety bonds will be specific to your risk. Check out some items that will impact your Tennessee pricing:

- The size of the job

- Your experience level

- Your cash flow

- Your financial records

- Prior losses

- If you've ever had a bond before

- Your assets

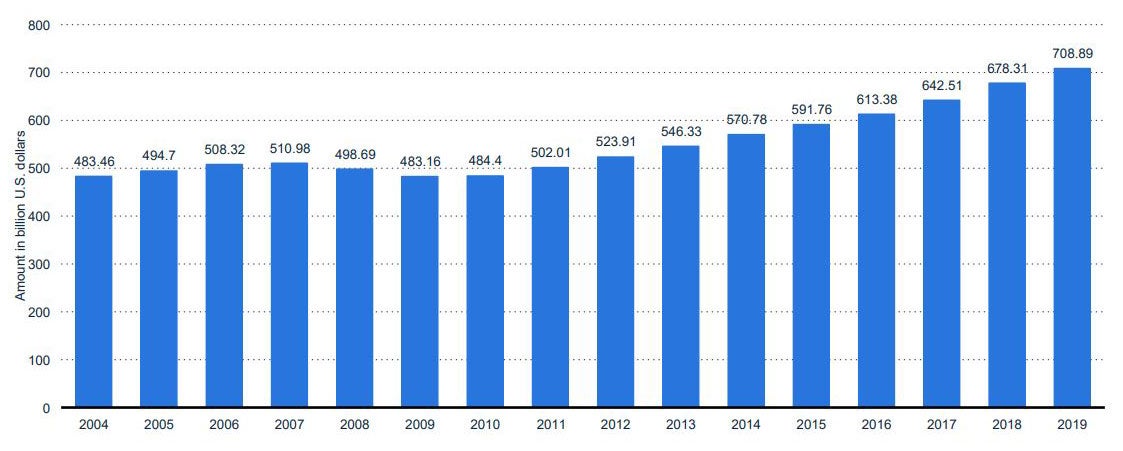

Commercial insurance premiums in the US (in billion US dollars)

Since an insurance company will have to guarantee completion of your work to another entity, they require proof of financials. They have to know you have the funds to back up the contract.

Is a Surety Bond Insurance in Tennessee?

It's essential that you be aware of the differences between lines of insurance and a business surety bond. Surety bonds are classified as a type of credit. Insurance carriers do sell surety bonds, which makes it confusing.

The risk is always with the principal, not an insurance company or the surety. This makes it fall into the credit category because the principal is obligated to pay back the bond.

Types of Surety Bonds in Tennessee

Tennessee has many kinds of surety bonds available. The type and amount of bond necessary will depend on what your risk is. Here are a few common ones, but there are more:

- Contract bonds

- Commercial bonds

- Auto dealer bonds

- Sales tax bonds

- Custom bonds

- Court bonds

- Fidelity bonds

Can a Tennessee Surety Bond be Used for Bail?

In Tennessee, if you have a bond set while awaiting trial, you are not obligated to stay in jail. If you can make bail, you'll be free to leave until your trial date.

A surety bond in this scenario is commonly referred to as a bail bond. It can guarantee the money necessary to post bail. This will be especially necessary when your trial date is far off. If you are without funds to pay on your own, a surety bond may be the way to freedom.

How to Get a Surety Bond in Tennessee with an Independent Agent

You may need a surety bond for business or personal reasons. In Tennessee, a business bond can help you secure a contract so you can get the job done. When you are bidding on a large task, it can be the clincher that brings you the deal.

A Tennessee independent insurance agent can help with coverage and rate options. They can find the best product that fits your budget at no additional cost. Connect with a local expert on TrustedChoice to get started today.

Article Author and Expert | Candace Jenkins

Graphic #1: https://www.statista.com/study/13212/property-crime-in-the-united-states-statista-dossier/

Graphic #2: https://www.statista.com/study/33205/property-and-casualty-insurance-in-the-united-states-statista-dossier/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.