In Tennessee, $6,317,565,000 in commercial insurance claims were paid in 2019 alone. If you're an anesthesiologist, there are several policies you'll need to be adequately insured. Tennessee business insurance can include coverage for anesthesiologist liability protection.

A Tennessee independent insurance agent can help with coverage and premium options that fit your budget. They do the shopping at no additional cost so that you have a professional for free. Connect with a local expert to get started.

Anesthesiologist Liability Insurance

If you're an anesthesiologist in Tennessee, liability insurance will protect your practice from a significant loss. An unanticipated loss can occur, and you could be held responsible. Your anesthesiologist liability insurance will cover a lawsuit arising out of the following:

- General liability claims

- Malpractice liability claims

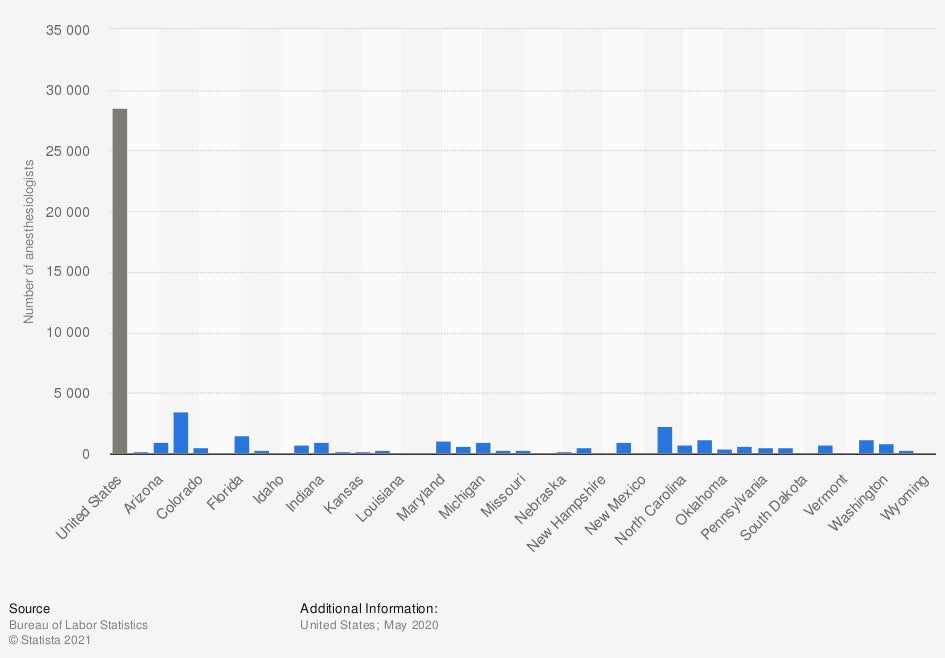

The number of anesthesiologists in the US, by state (in thousands)

This is a growing field that should be properly protected. If you're one of the thousands of anesthesiologists in Tennessee, you'll need to know how coverage works.

What Does Anesthesiologist Liability Insurance Cover in Tennessee?

In Tennessee, anesthesiologist liability insurance can come in many different forms. Some of the most common are listed below:

General liability insurance: This is the primary form of liability coverage for your practice, and it provides the following:

- Bodily injury coverage

- Property damage coverage

- Slander coverage

Malpractice liability insurance: This is another necessary liability coverage for an anesthesiologist. If you cause damage at any time, you could be responsible. Take a peek at what a policy could include:

- Assault coverage for claims made against you or your staff

- License protection coverage

- Legal representation

- Defendant expense benefits

- Personal liability coverage

- Personal injury protection

Commercial umbrella policy: This adds an extra layer of protection for your anesthesiologist practice. Check out how it works:

- Additional coverage for bodily injury

- Additional coverage for property damage

- Additional coverage for slander

What Doesn't Anesthesiologist Liability Insurance Cover in Tennessee?

Your commercial insurance will come with exclusions. In Tennessee, your policies will have specific items that they will not include under your coverage. Check out some standard anesthesiologist liability exclusions:

- Business property: This falls under a business property policy.

- Equipment: This falls under an equipment breakdown policy.

- Employee wages: This will fall under workers' compensation insurance in some cases.

- Vehicles: This will fall under a commercial auto policy.

- Floods: This is a separate flood policy.

- Earthquakes: This is a separate earthquake policy.

Do Anesthesiologists Need Malpractice Insurance in Tennessee?

Medical malpractice insurance is necessary for any anesthesiologist in Tennessee. Whether you're on your own or working with a hospital, you'll usually be required to carry it. Check out how it works:

- Malpractice occurs when a doctor or healthcare provider deviates from the medical community's usual standards and causes injury or death to the patient.

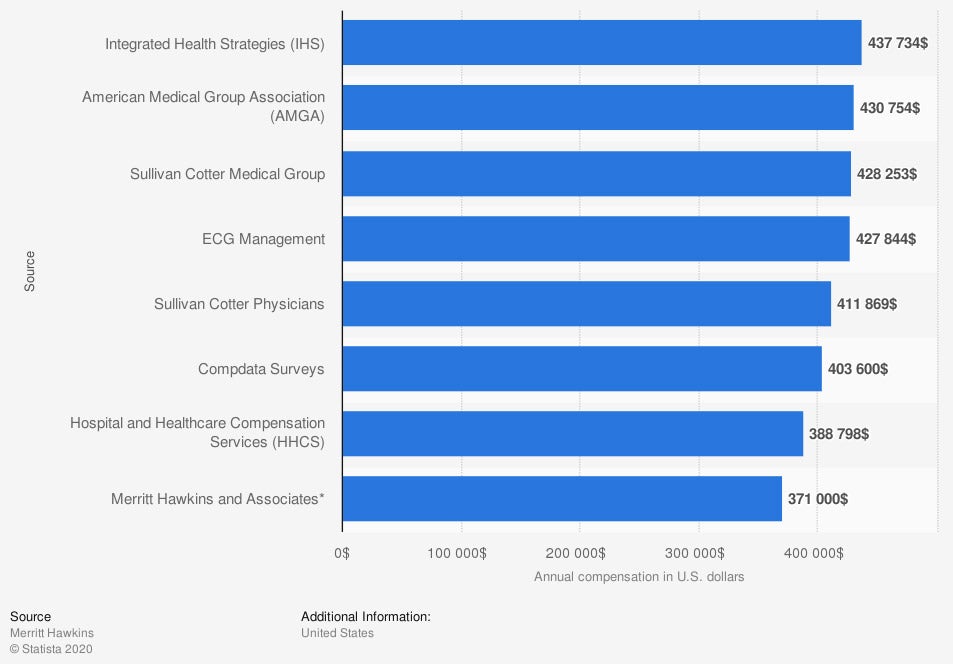

Annual compensation of anesthesiologists in the US, by data source (in thousands)

You'll want to protect your livelihood no matter what profession you choose. Anesthesiologists, on average, make a larger salary than most and will need more coverage.

How Much Do Anesthesiologist Pay for Malpractice Insurance in Tennessee?

The price for Tennessee Anesthesiologist insurance will vary from person to person. There are risk factors that will impact your malpractice premiums. Take a look at what affects your malpractice costs below:

- Your safety practices

- Prior malpractice claims

- How experienced you are as an anesthesiologist

- How much coverage you select

- Your gross annual sales

- Your financial practices

How to Connect with a Tennessee Independent Insurance Agent

Your Tennessee business insurance will help protect your assets and income. When comparing coverage and rates, it's helpful to have a licensed professional. Anesthesiologist liability insurance can come in several forms and should be reviewed for accuracy.

Fortunately, a Tennessee independent insurance agent will have access to multiple markets. They do the shopping at no extra cost to your practice so that you can save. Connect with a local expert on TrustedChoice for superior protection.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

Graphic #1: https://www.statista.com/statistics/1230971/number-of-anesthesiologists-in-the-united-states/

Graphic #2: https://www.statista.com/statistics/957434/anesthesiologist-compensation-us-by-data-source/

http://www.city-data.com/city/Tennessee.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.