There are several responsibilities you'll have as a business owner. One of them is avoiding serious financial disasters by any means. Tennessee business insurance can help protect your jewelry store with custom coverages.

A Tennessee independent insurance agent has access to multiple markets so that you're fully covered. They'll even do the shopping for you at no additional cost, making it super-easy. Connect with a local expert to get started in minutes.

What Is Jewelry Store Insurance?

In Tennessee, your jewelry store will have some high-priced valuables that need protecting. Check out some common coverage choices for jewelry stores below:

- General liability: Pays for a bodily injury and property damage loss of others.

- Business property: Pays for the replacement or repair of company-owned property and belongings.

- Business interruption: Pays for regular business expenses while your company has to shut down due to a covered loss.

- Business inventory: Pays for the replacement or repair of company-owned inventory.

- Business equipment breakdown: Pays for replacing or repairing company-owned equipment that breaks down due to a covered loss.

- Commercial umbrella liability: Pays for a bodily injury and property damage loss of others after it exhausts your underlying limits.

- Workers' compensation: Pays for medical expenses and lost wages due to employee injuries or illness resulting from job duties.

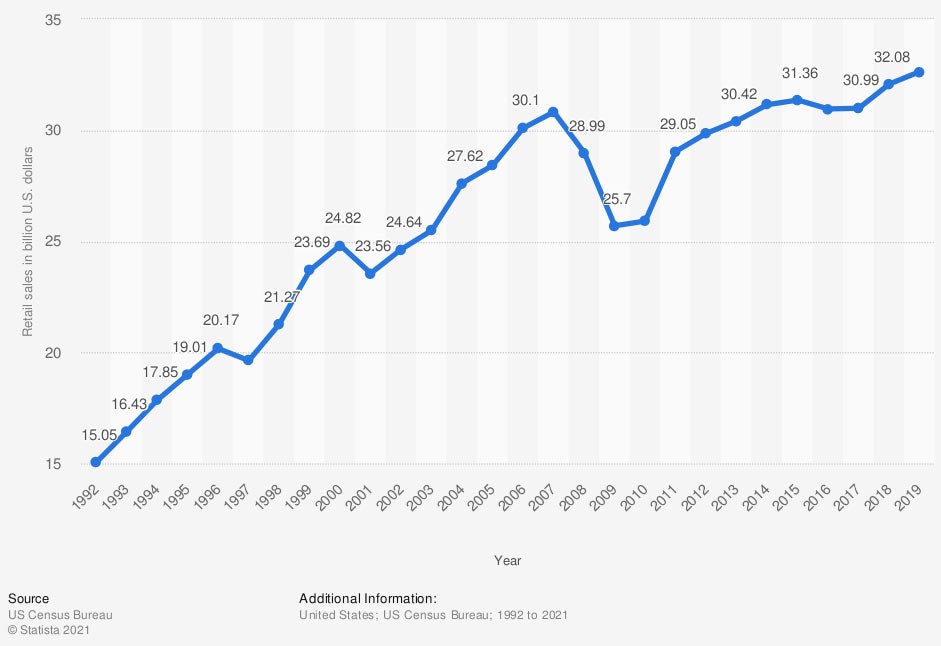

Jewelry store sales in the US

Jewelry store sales don't seem to be slowing down, which means you could have a viable business on your hands. To get the most out of it, you'll want proper coverage for your operation.

What Does Jewelry Store Insurance Cover in Tennessee?

Tennessee has 603,310 small businesses in existence currently. For your business, there are standard jewelry store policies. Let's look at common jewelry store coverages:

- Coverage for bodily injury or property damage claims

- Coverage for your business inventory such as products

- Coverage for business equipment that breaks down due to a covered loss

- Coverage for employees who are injured or become ill on the job

- Coverage for commercial vehicles used to operate the business

- Coverage for disgruntled employees that sue due to discrimination or harassment

Your policies will also include basic property coverages for fire, theft, vandalism, and severe weather. Limits of your choice can be preselected with your adviser.

How Much Is Jewelry Store Insurance in Tennessee?

Insurance companies look at several risk factors when calculating your business coverage premiums. In Tennessee, $6,317,565,000 in commercial insurance claims were paid one year alone. Each jewelry store insurance policy will cost differently depending on your exposures. Take a look at the factors carriers consider when quoting:

- Loss history

- Replacement cost values

- Insurance score

- Experience level

- Type of retail store

- Location

How Much Theft Is Covered under Tennessee Jewelry Store Insurance?

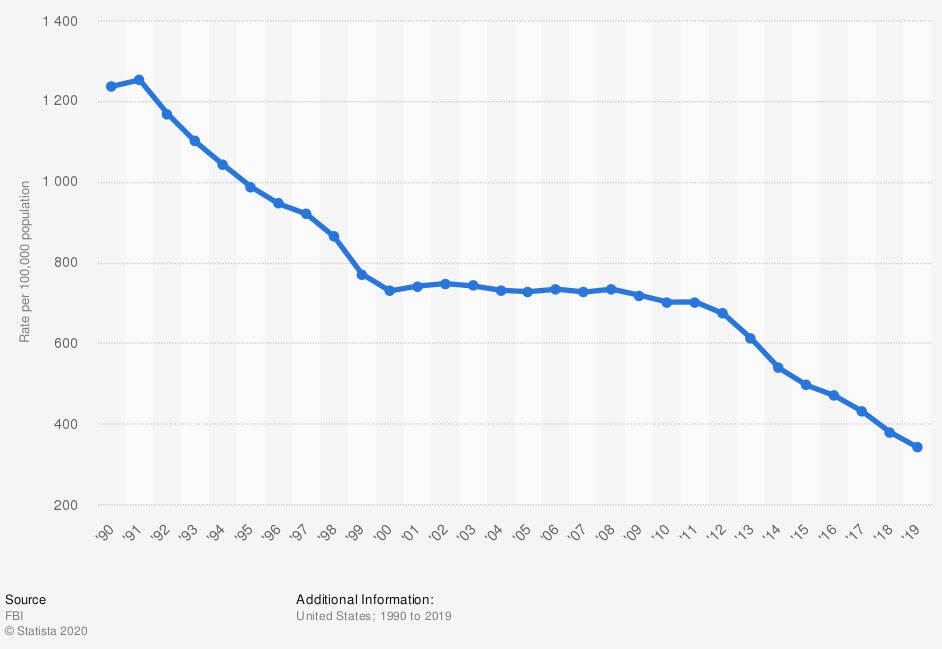

Valuables like jewelry are targeted by criminals everywhere. Your Tennessee jewelry store may be at a higher risk for theft than most. Fortunately, theft is covered under your property policy. Take a look at the property crime rates below:

Reported property crime rates in the US

More local crime in your area will impact your policy costs as well. The riskier your location is, the more your policy premiums will be.

Will My Tennessee Location Impact My Insurance Rates?

Where you decide to place your Tennessee jewelry store will affect your insurance premiums. Carriers use your territory to determine what you'll pay for business insurance based on numerous rating factors. Things like crime rates, flood zones, and the number of reported claims in the area are all factors used.

How an Independent Insurance Agent Can Help in Tennessee

If you own a jewelry store in Tennessee, you'll want the perfect commercial policies to help protect your operation. High-priced valuables like jewelry will need more property coverage than most. Fortunately, you don't have to find a policy all on your own.

A Tennessee independent insurance agent works with numerous carriers, giving you options. They'll find coverage that's sufficient and affordable without charging an additional fee. Connect with a local expert on trustedchoice.com for tailored quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/197698/annual-jewelry-store-sales-in-the-us-since-1992/

https://www.statista.com/statistics/191237/reported-property-crime-rate-in-the-us-since-1990/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.