When you're traveling on the road for fun or because you have to get to a destination, you'll want coverage. Each policy comes with options, and knowing which is needed helps you avoid financial ruin. Tennessee car insurance may have coverage for hitting a deer, depending on your limits.

A Tennessee independent insurance agent can help you find a policy that suits your needs and fits your budget. They have access to numerous markets so that you have options. Connect with a local expert to get started in minutes.

What Is Car Insurance?

If you hit a deer while driving, it can create confusion regarding coverage. When you have coverage in place beforehand, it helps. To obtain the proper protection, take a look at how car insurance can help:

- Car insurance: This policy comes with many coverage options and protects against a lawsuit arising from bodily injury, property damage, or physical damage.

What Does Car Insurance Cover in Tennessee?

The majority of states have a minimum liability limit requirement in order to drive. Tennessee has requirements for personal and commercial auto insurance, and they are as follows:

- Minimum limits of auto liability in Tennessee: $25,000 per person/ $50,000 per accident/ $15,000 property damage

- Property: Coverage for damage to vehicles and outside property

- Liability: Coverage for bodily injury or property damage

- Medical: Coverage for your medical expenses due to an at-fault loss

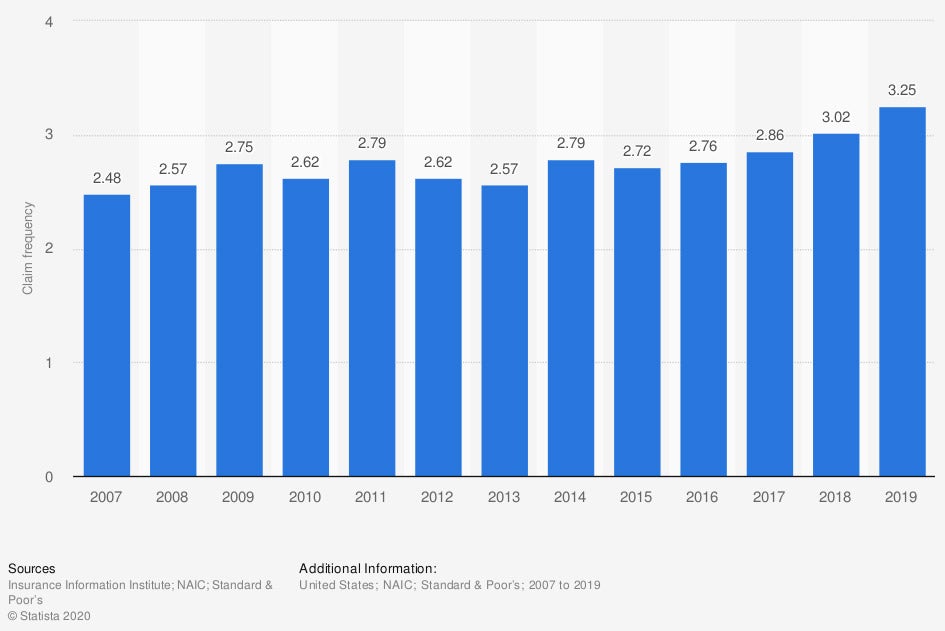

Frequency of private passenger comprehensive auto insurance claims for physical damage in the US

When you strike an animal on the road, coverage falls under a specific limit. If your car policy doesn't have optional protection, then you might not be insured for all losses.

What Doesn't Car Insurance Cover in Tennessee?

In Tennessee, $2,492,018 in car insurance claims were paid in just one year . If you want more than the minimum limits of liability protection, you'll have to add it.

Optional car insurance coverages:

- Gap coverage: Pays for the difference between your remaining loan balance and the market value when a total loss occurs.

- Tow coverage: Will pay for a tow truck to tow a covered auto due to a loss.

- Rental car coverage: Will provide reimbursement for a rental car when your covered auto is damaged.

- Comprehensive coverage: Will pay for property damage to your vehicle that is hit by an unavoidable obstruction. It also pays for fire, theft, vandalism, and severe weather damage.

- Collision coverage: Pays for property damage to your car in the event of a crash when you're at fault.

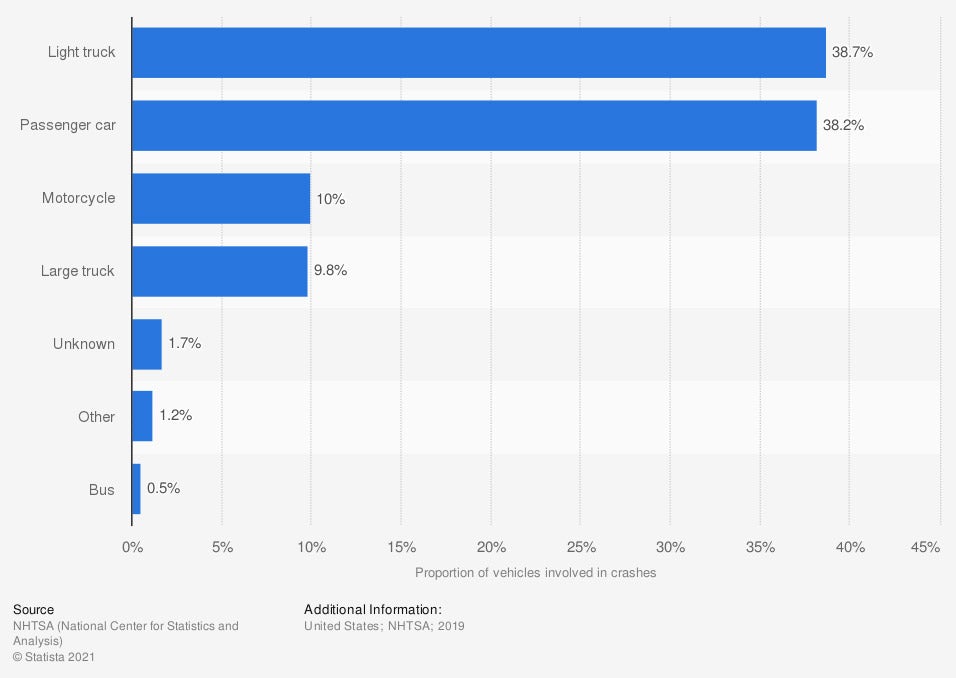

Distribution of vehicles involved in fatal traffic crashes in the US in one recent year

The number of car accidents that turn tragic is more than most would like to believe. Coverage for all scenarios of an auto loss is crucial to avoid unnecessary expenses.

Does Car Insurance Cover Hitting a Deer in Tennessee?

Your Tennessee auto policy will not cover a loss involving hitting a deer automatically. Replacement or repair for damage when you have hit a deer falls under comprehensive coverage. This limit needs to be added to each auto on your policy and is optional.

Comprehensive and collision is an additional premium and usually doubles your car insurance costs. A deductible of between $500 and $1,000 is typical, and is the portion you'll be responsible for paying first.

How to File a Claim after Hitting a Deer in Tennessee

When you're involved in a car accident, it can be overwhelming. If you're at a loss, follow these simple steps to file a claim after hitting a deer in Tennessee:

- Step 1: Get to a safe place and seek medical attention if necessary.

- Step 2: Call your independent insurance agent to file a claim.

- Step 3: Obtain information from your agent on a replacement rental vehicle if needed.

- Step 4: Set up a meeting with your assigned adjuster to go over the damage to your vehicle.

How an Independent Insurance Agent Can Help You in Tennessee

The perfect car insurance policy for your vehicles and household drivers is possible if you know where to look. There are numerous options when it comes to your auto coverage, making it confusing. Fortunately, a licensed professional can help you review your policy for free.

A Tennessee independent insurance agent has a network of highly rated carriers to quote your coverage through. Since they do the shopping at zero cost, having an adviser in your corner is a no-brainer. Connect with a local expert on trustedchoice.com to obtain coverage for hitting a deer and more.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/830114/comprehensive-car-claim-frequency-physical-damage-usa/

https://www.statista.com/statistics/192089/vehicles-involved-in-traffic-crashes-in-the-us/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.