When you're a licensed driver, there are some things you'll be responsible for knowing before taking to the streets. The right protection for all that the open roads throw at you is necessary to avoid financial risk. Tennessee car insurance will be able to cover storm damage to your vehicle if you know where to look.

Fortunately, a Tennessee independent insurance agent has access to several markets so that you're covered for an affordable price. They'll review your policy for free to make sure you're getting the right protection. Connect with a local expert for tailored quotes in minutes.

What Is Storm Insurance?

When a storm occurs in Tennessee, it can cause damage to your car in a matter of seconds. To avoid paying out of pocket, you'll need the proper coverage. Take a look at how storm insurance can help:

- Storm insurance: Insurance for storm damage to your vehicle is added to each policy under comprehensive limits. Tornadoes, hurricanes, severe winds, lightning, and hail damage could all be insured under this coverage type.

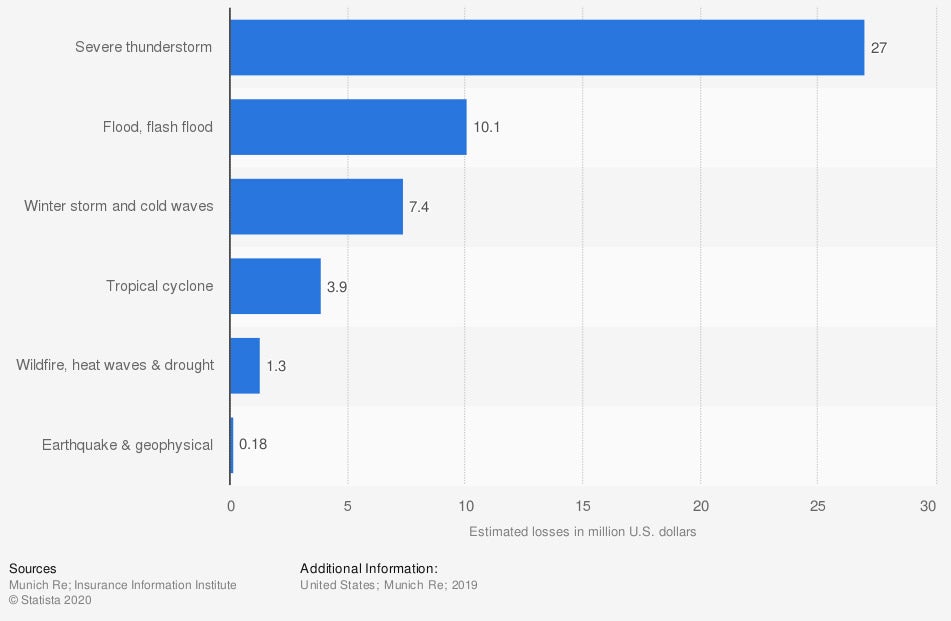

Estimated overall losses due to natural disasters in the US, by type (in million US dollars)

If you're involved in a storm, it can wreak havoc that you may not be prepared to handle. It's essential to understand what you're up against and get proper coverage.

What Does Storm Insurance Cover in Tennessee?

Contrary to popular belief, storm damage to your car doesn't come automatically. Comprehensive coverage is necessary when you want insurance for physical damage to your vehicle. Check out what comprehensive limits in Tennessee will cover for storm damage:

- Hail damage to your car

- Wind damage to your car

- Tornado damage to your car

- Lightning and fire damage to your car

- Hurricane damage to your car

- Other severe storm-related damage to your car

Am I Covered If I Am Injured in a Storm While Driving in Tennessee?

In Tennessee, your medical payments coverage under your car policy will help pay for injury due to a covered claim. It's crucial to obtain a limit that is sufficient for a larger loss. Medical insurance limits are set by state and used to cover your injuries when involved in an accident that's not another party's fault.

What's Not Covered under Storm Damage Insurance in Tennessee?

Every policy comes with a list of exclusions. In Tennessee, $2,492,018 in car insurance claims occurred in one recent year, making it important to have the right coverage. Check out coverage is typically not included under your auto policy in Tennessee for storm damage:

- Comprehensive insurance: This pays for damage to your vehicle when an animal hits your car, a fire loss happens, or for hail and storm damage. This coverage is optional and will need to be added to have protection.

- Flood insurance: Flood damage to your vehicle is also covered under comprehensive insurance. To add this limit of coverage, it will cost an extra premium.

Are Personal Belongings inside Your Car Covered under Insurance in Tennessee?

When a storm damages your car, personal belongings inside your vehicle can sustain a loss as well. In order to have coverage for your property, you'll need to add comprehensive insurance under your optional policy limits.

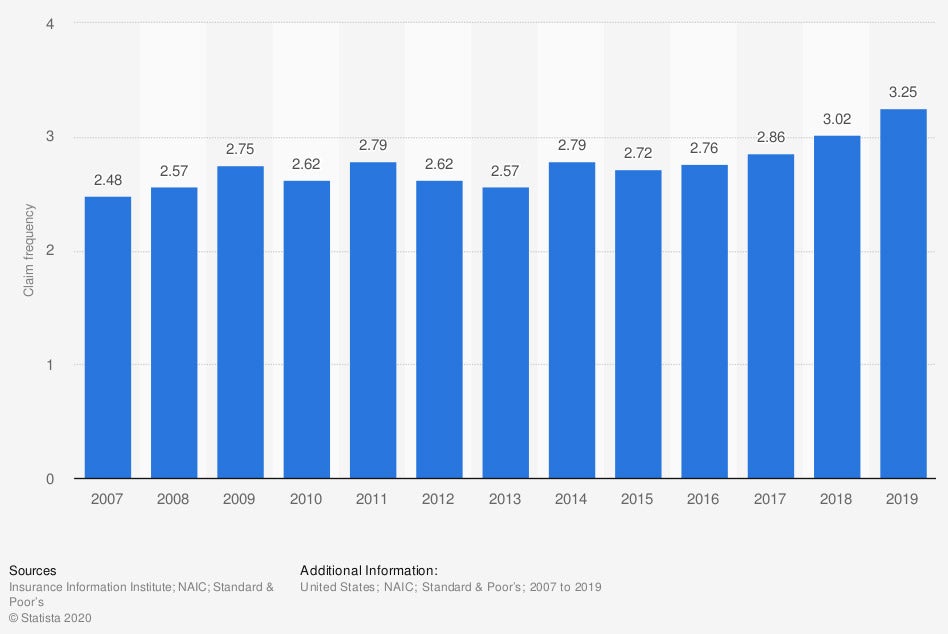

Frequency of private passenger comprehensive auto insurance claims for physical damage in the US

There are several losses that would call for comprehensive coverage. The proper insurance is necessary to avoid paying for a claim out of pocket.

How to File a Claim for Storm Damage to Your Tennessee Car

It can be hard to know where to start when a loss occurs to your vehicle. It's vital to have a plan before damage happens. Follow these simple steps to file a car insurance claim in Tennessee:

- Step 1: Get to a safe place.

- Step 2: Call your independent insurance agent to file a claim.

- Step 3: Get a replacement vehicle while your car is being repaired.

- Step 4: Set up a meeting with your assigned adjuster .

How a Tennessee Independent Insurance Agent Can Help You

When you're looking for coverage that protects you from storms, consider using a trained professional. Your car insurance will need specific limits in order to pay for a loss involving a natural disaster. Fortunately, a trusted adviser can review your policies for free, saving you time and money.

A Tennessee independent insurance agent quotes your coverage through a network of highly rated carriers so that you have options. They'll even do the shopping at zero cost, making it a no-brainer. Connect with a local expert on trustedchoice.com for custom quotes in minutes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/216836/estimated-overall-losses-due-to-natural-disasters-in-the-united-states/

https://www.statista.com/statistics/830114/comprehensive-car-claim-frequency-physical-damage-usa/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.