Doing your part as a safe driver isn't always enough to keep you protected, sadly. Since hit and run accidents do happen, it's critical to understand what to do afterwards in case one ever affects you. That starts with knowing who's responsible for covering the damage to your vehicle and when to file a claim.

A Tennessee independent insurance agent can help you get the protection you need against hit and runs and many other catastrophes with the right car insurance. But first, here's a closer look at hit and runs in Tennessee and what happens after an accident.

In Tennessee, Who's Responsible for a Hit and Run?

Since Tennessee is classified as an "at-fault" state, that means the driver that hit you and sped off can legally be held responsible for the damage. Also, Tennessee is classified as a "comparative negligence" state, meaning every party involved in a car accident gets assigned a percentage of liability. In the case of a hit and run, with the right evidence, the driver that caused the accident and then fled is likely to be held 100% liable.

Drivers in Tennessee who are assigned at least 50% of the liability for an accident can't collect reimbursement from a lawsuit. Assuming you're equipped with the right type of Tennessee car insurance, you should be able to recover the cost of the damage or destruction to your vehicle after a hit and run.

Will I Have to File a Claim through My Own Insurance?

Yes, you will be responsible for filing a claim through your own car insurance policy after a hit and run. Fortunately your coverage can protect you in multiple ways, even if the other driver flees the scene and you never get to exchange insurance information. Make sure to work with a Tennessee independent insurance agent to get covered with the right types of car insurance to protect you against all kinds of accidents, including hit and runs.

What Type of Car Insurance Protects Me from a Hit and Run?

According to insurance expert Jeffery Green, "Assuming another driver hits your car and leaves the scene, you would be covered if you have collision coverage, or uninsured motorist coverage." Here's a breakdown of how each type of car insurance would protect you in most places:

- Collision coverage: Reimburses you for damage to your car if you're involved in a collision.

- Uninsured motorist coverage: Reimburses you for damage if you get into a collision with another driver that doesn't carry any or enough car insurance of their own.

Uninsured motorist coverage can also protect you in the case of a hit and run, though, if you never even get the chance to check the at-fault driver's insurance. Make sure to work with a Tennessee independent insurance agent to get equipped with all the car insurance you need to feel safe.

Are Uninsured Drivers Common in Tennessee?

An estimated 13% of drivers nationwide are uninsured. Unfortunately Tennessee's rate of uninsured drivers far surpasses this national average.

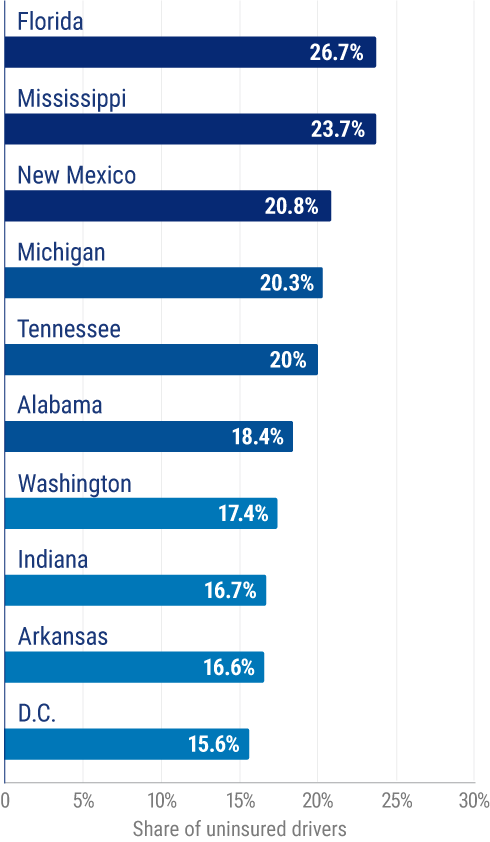

States with highest percentage of uninsured drivers in the US

Tennessee falls in the top five states with the highest percentage of uninsured drivers in the country, at a whopping 20%. That's one in every five drivers on the road without enough car insurance. The states with the highest percentage of uninsured drivers overall were Florida, at 26.7%, and Mississippi, at 23.7%.

Knowing the odds of getting into an accident with an uninsured driver in Tennessee, it's more important than ever to make sure you're equipped with uninsured motorist coverage. In fact, Green said that the most important thing to understand about car insurance in Tennessee is the importance of having uninsured motorist coverage to protect you against hit and run damage and much more.

What Does Car Insurance Cover in Tennessee?

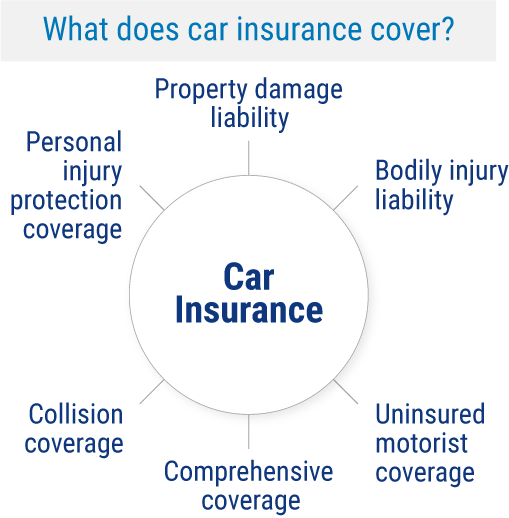

Tennessee's minimum car insurance requirements by state law include $25,000 of bodily injury liability per person and $50,000 per accident, as well as $15,000 of property damage liability per accident. However, there are a handful of coverages that are most commonly purchased, including:

- Property damage liability: Protects drivers against damage to property, like lamp posts or fences, if they hit them with your vehicle.

- Bodily injury liability: Protects drivers against injuries to another driver and their passengers if they cause an accident.

- Uninsured motorist coverage: Protects drivers that get into an accident with another driver who does not carry adequate insurance of their own, which is crucial in the case of hit and runs.

- Comprehensive coverage: Protects against other hazards to your vehicle, including storm damage, floods, theft, vandalism, windshield damage, and more.

- Collision coverage: Protects against damage to the driver’s vehicle if they get into a collision with another car.

- Personal injury protection coverage: Protects against medical costs from injuries to the driver and their passengers after an accident.

Green added that it doesn't matter which insurer you have, because all auto insurance in a state operates the same way. A Tennessee independent insurance agent can get you set up with the coverage you need.

Will My Car Insurance Rates Increase Even If I’m Not Responsible for the Crash?

Drivers in Tennessee are in luck, because insurers are prohibited by the state from increasing car insurance premiums if you're not at fault for an accident. So you're not going to be punished with more expensive coverage if you have to use your uninsured motorist insurance. Knowing this, hopefully you can feel a bit more at ease in case of this type of accident.

Why Choose a Tennessee Independent Insurance Agent?

It’s simple. Tennessee independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

Tennessee independent insurance agents also have access to multiple insurance companies, ultimately finding you the best car insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

Article Reviewed by | Jeffery Green

enjuris.com/tennessee/car-accidents/hit-and-run.html#:~:text=Tennessee%20is%20an%20at%2Dfault,of%20liability%20for%20the%20accident.

statista.com/statistics/784659/states-with-highest-percentage-of-uninsured-drivers-usa/

nstlaw.com/faqs/will-my-car-insurance-go-up-if-i-use-it/

© 2025, Consumer Agent Portal, LLC. All rights reserved.