In Tennessee, storms are common, especially those that can cause flooding. Since all that water has to go somewhere, sadly sometimes it finds its way into your home. So what happens if there's a clog in your gutters and the water backs up into your basement, causing an indoor flood?

A Tennessee independent insurance agent can help you get protected against this disaster and many others with the right homeowners insurance. They'll get you covered long before disaster strikes. But first, here's a deep dive into who's responsible in this specific incident.

How Do Gutters Cause Indoor Flooding?

You trust the equipment installed on your home to do its job properly, but this doesn't always happen. Even your gutters malfunctioning can lead to basement floods. Here's how.

Gutters can cause basement floods because of:

- Defective pitches: A defective pitch, or the part of the gutter that leads water, etc. to the downspouts, can cause a backup that eventually sends it and other runoff into the home.

- Bad downspouts: Downspouts that are missing or not properly installed can also cause water backups that eventually come indoors.

- Clogs: Gutters clogged by leaves and other debris are one of the biggest culprits in water backups and home flooding.

- Missing splash blocks: Without splash blocks to direct water and runoff away from your home, the collection of water can cause basement floods as well as problems with your foundation.

- Loose gutters: Without tightly installed gutters, your home is much more prone to water seeping inside.

It's important to inspect your gutters and all their components on a regular basis to help prevent basement floods.

Who’s Responsible If the Gutters Flood Water into My Basement?

You may know your gutters weren't installed properly, but that doesn't mean your homeowners insurance does. You might have to get a home inspection after filing a claim for a basement flood to prove the damage was the fault of the gutter installer. From there, you could file a claim against them through your homeowners insurance.

However, if you hired a gutter installer that wasn't legitimate or didn't have coverage of their own to cover the damage, you could be out of luck. Always ask for proof of insurance when hiring professionals to do work on your home. Otherwise, make sure you're properly protected by the right home insurance with the help of a Tennessee independent insurance agent.

Am I Covered for Basement Flood Damage with My Home Insurance?

That really depends on the cause of the flooding. Indoor flooding caused by plumbing-related issues like broken pipes isn't technically considered a "flood" by insurance companies, and is covered. But flooding caused by natural water damage, such as from a hurricane, is always excluded.

Homeowners insurance covers the cost of damage related to plumbing issues, and also the cost of having to tear out walls to get to the pipes to repair them, etc. But you'll never find coverage through homeowners insurance to cover natural floodwater damage. You'll always need a separate Tennessee flood insurance policy for that.

What about Other Common Causes of Tennessee Flooding?

Here's a look at the top causes of flooded homes in Tennessee and whether homeowners insurance covers them.

Most common disasters leading to home flooding in Tennessee:

- Broken pipes: Homeowners insurance does cover the cost of repairing broken pipes or other plumbing that leads to indoor floods.

- Faulty drainage: If your gutters don't drain properly because they weren't installed properly, you'll need to be able to prove that to your homeowners insurance company to get coverage.

- Clogged gutters: It's your responsibility as a homeowner to keep your gutters cleared, since home insurance doesn't cover damage caused by your negligence.

- Broken appliances: Flooding caused by broken appliances is also covered by homeowners insurance.

- Damaged foundation: Your homeowners insurance isn't likely to cover flooding caused by a damaged foundation. It could be considered wear and tear on your home, which is excluded.

- Natural disasters: Flooding caused by natural disasters like hurricanes, typhoons, heavy rainfall, etc. isn't covered by home insurance.

The best defense against indoor flooding is a strong offense. Make sure you're keeping up with your home's maintenance and checking out all of its elements that are designed to keep water outside as often as possible.

What Does Home Insurance Cover in Tennessee?

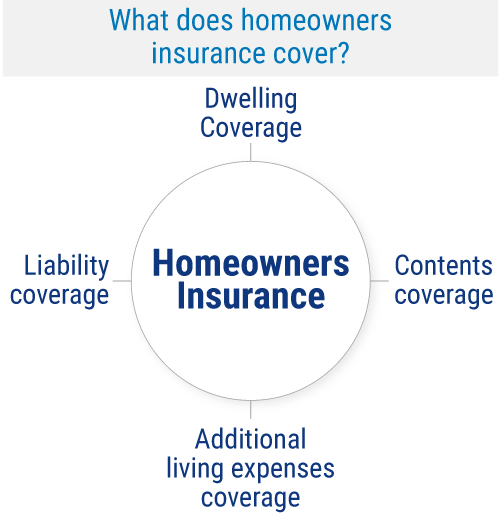

Homeowners insurance in Tennessee covers many incidents beyond basement flooding. Basic coverage includes:

- Dwelling coverage: Your home's structure is protected against many threats like fire, storm damage, vandalism, etc.

- Contents coverage: Your personal property like clothing and furniture is also protected against many threats like fire, theft, etc.

- Liability coverage: You're covered against legal expenses like attorney, court, and settlement fees if you get sued by a third party for claims of bodily injury or property damage.

- Additional living expenses coverage: You're also covered against additional costs that may arise if you're forced to live at a hotel or other temporary residence while your home is being repaired after a covered disaster.

Working with a Tennessee independent insurance agent is a great way to get equipped with a homeowners insurance policy that covers you in every area.

How Can You Reduce Basement Flooding Claims in Tennessee?

According to insurance expert Paul Martin, the best way to make sure that you'll never experience a basement flood is to buy or rent a home on a hill or otherwise at elevation. Insurance companies specifically exclude natural flood damage because "it floods where it floods." Research your town's FEMA-marked flood zones to be extra careful when choosing where to live.

If you've already moved in, then stay up to date with your home repairs and routine inspections. Also, when hiring outside help to make any modifications to your home, always get proof of proper insurance first. Remember, the best defense against basement floods and other home disasters is a strong offense.

Why Choose a Tennessee Independent Insurance Agent?

It’s simple. Tennessee independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

Tennessee independent insurance agents also have access to multiple insurance companies, ultimately finding you the best homeowners insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

Article Reviewed by | Paul Martin

iii.org/article/do-i-need-flood-insurance-for-my-home

iii.org/article/which-disasters-are-covered-by-homeowners-insurance

iii.org/article/how-protect-your-home-water-damage

© 2024, Consumer Agent Portal, LLC. All rights reserved.