If you're a licensed driver, there are rules of the road that need to be followed. You'll have protection from storms, natural disasters, and more if you have the proper coverage. Tennessee car insurance will have limits for hail damage to your vehicle when you have the right policy.

A Tennessee independent insurance agent will do the shopping through their network of carriers. They'll compare coverage and rates to ensure that you're getting the best protection on the market. Connect with a local expert on for custom quotes.

What Is Car Insurance?

Your Tennessee car insurance is mandated by state law. The minimum limits of liability are non-negotiable and must be obtained to drive. Take a look at what is needed and what is included in your policy below:

Minimum limits of auto liability in Tennessee:

- $25,000 per person/ $50,000 per accident/ $15,000 property damage

Your auto policy will provide coverage for the following:

- Property: Coverage for damage to vehicles and outside property

- Liability: Coverage for bodily injury or property damage

- Medical: Coverage for your medical expenses due to an at-fault loss

What Does Car Insurance Cover in Tennessee?

The standard minimum limits of liability in Tennessee are the only thing included under your auto policy. When you want protection for damage and more, you'll need to add it. In the meantime, check out some options:

- Gap coverage: Pays for the difference between your remaining loan balance and the market value when a total loss occurs.

- Tow coverage: Will pay for a tow truck to tow a covered auto due to a loss.

- Rental car coverage: Will provide reimbursement for a rental car when your covered auto is damaged.

- Collision: Pays for damage to your vehicle when you collide with another object, and it's your fault.

What Doesn't Car Insurance Cover in Tennessee?

Tennessee does not require uninsured/underinsured motorist (UM/UIM) coverage, but it's necessary. Let's check out what it covers under your car insurance policy:

- UM/UIM: This coverage will pay for your expenses arising from an accident with an uninsured at-fault driver. Coverage starting at $25,000 per person/$50,000 per accident/ $15,000 property damage.

- National average of uninsured drivers: 13.0%

- Tennessee average of uninsured drivers: 20.0%

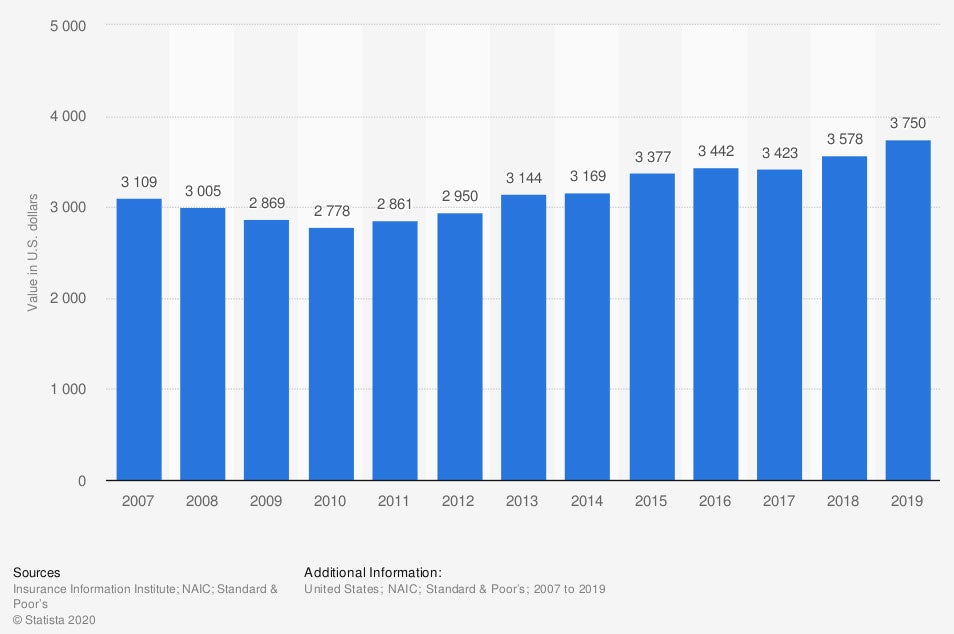

Average value of private passenger auto collision insurance claims for physical damage in the US (in US dollars)

When you're trying to have protection for every possible outcome, having enough insurance is vital. What's around the corner could be unexpected, and it's best to be proactive.

How Much Hail Damage Is Covered under Car Insurance in Tennessee?

In Tennessee, hail damage to your vehicle can occur at any moment. Your auto policy will have protection if you've obtained the proper coverage. Check out which limit to add:

- Comprehensive coverage: This limit is optional and will pay for damage to your covered autos. This covers a loss caused by fire, severe weather, hail, or an obstruction hitting your vehicle.

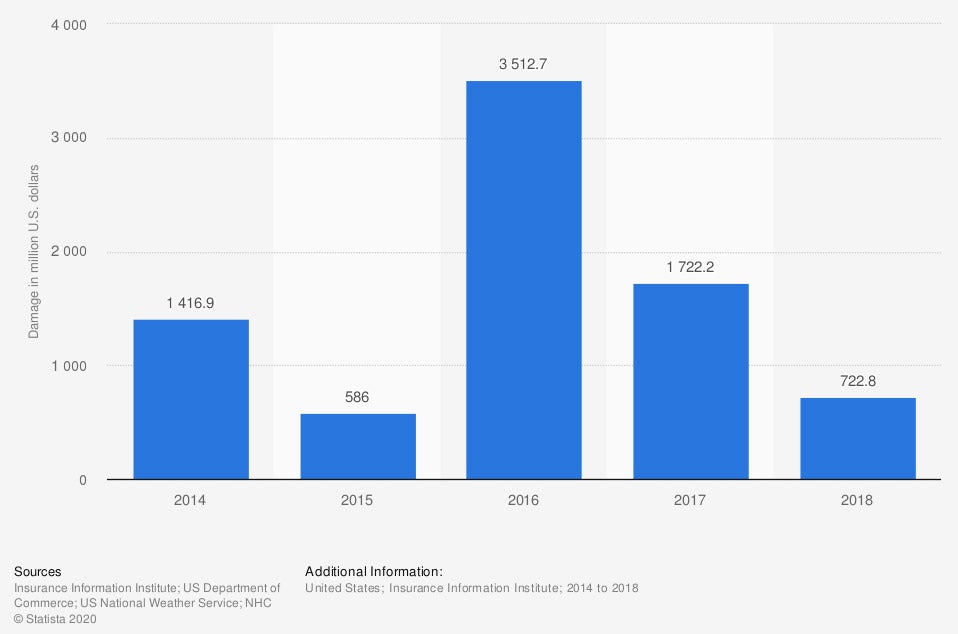

Property damage from hail in the US (in million US dollars)

There is a chance you'll encounter hail during a storm if you're auto is not in a covered surrounding. The amount of coverage your policy has for hail damage depends on your deductible and the value of your car.

Disasters Your Car Insurance Will Cover in Tennessee

Your Tennessee car insurance policy will automatically come with coverage for bodily injury and property damage to another party. If you want insurance for severe weather damage like hail to your personal vehicle, it's optional.

Comprehensive insurance is the primary coverage you'll need to have protection against storm damage and more. You'll have a deductible of between $500 to $1,000 in most cases.

How a Tennessee Independent Insurance Agent Can Help You

When you're searching for the best protection in Tennessee, a trusted adviser can help. Your auto policy will come standard with liability limits, but if you want coverage for hail damage, you'll have to add it. Fortunately, you're not alone, because a licensed professional can review your policies for gaps at no cost.

A Tennessee independent insurance agent will do the shopping through their network of carriers. They'll compare coverage and rates to ensure that you're getting the best protection on the market. Connect with a local expert on trustedchoice.com for custom quotes.

Article Author | Candace Jenkins

Article Expert | Jeffrey Green

https://www.statista.com/statistics/830170/collision-claim-size-for-physical-damage-usa/

https://www.statista.com/statistics/1015618/property-hail-damage-usa/

http://www.city-data.com/city/Tennessee.html

© 2025, Consumer Agent Portal, LLC. All rights reserved.