Elements installed beneath the ground under your home can end up causing you a world of trouble one day, as well as tons of costly damage. So who's responsible if a sewage line busts in Tennessee? Who pays for the damage and files a claim?

A Tennessee independent insurance agent can help you find the right type of homeowners insurance to protect you from this disaster and many others, well before you ever need to use it. But for starters, here's a behind-the-scenes look at who's responsible in this unique scenario.

In Tennessee, Who's Responsible for Busted Sewage Lines?

The sewage lines running beneath your home are considered your responsibility as the homeowner. So if one busts, it's still on you to file a claim through your Tennessee homeowners insurance. Unfortunately, even though you had no control over the installation of your home's sewage lines, they can still end up costing you big in case of an incident.

Are Sewage Lines Ever the City, County, or State’s Responsibility?

It's most often considered the property's owner's responsibility if a sewer line busts, but not 100% of the time. Homeowners can still be held responsible for sewage lines even if they run outside of their marked property line. That said, you'll want to check in with your local municipal sewer department to be certain.

Often the city starts to be held responsible for sewage lines from the main underground pipe, which leads sewage to the treatment plant and away from your property. Sewer mains are most often found past your property line. But again, it's imperative to check your local regulations to be sure of what parts of your sewer line you're responsible for.

How Much of the Damage Is My Responsibility?

The reason the sewage line actually busted will impact how much damage you're responsible for. You'll want to make sure you have a sewer backup endorsement added to your home insurance policy to be safe, regardless. If the sewage line busted due to defective plumbing, your homeowners insurance would probably pay for much of the resulting damage after you covered your deductible.

Will My Rates Be Affected Even Though I’m Not Responsible for the Bust?

According to insurance expert Paul Martin, you'd be unlikely to experience home insurance premium increases after a single incident like this one. However, if you started filing this type of claim often, you could end up losing your home insurance altogether. But for just one sewage line claim, especially if it wasn't your fault, your rates probably wouldn't change.

How Common Are Sewage Line Busts in Tennessee?

FACT: More than 850 sewage line breaks happen every day in the North America.

Temperature fluctuations and many other causes can lead to sewage line busts. A change of just 10 degrees one way or the other in the weather can lead to a broken line. In Tennessee, here are top causes of busted sewer lines:

- Ice storms and freezing

- Flooding and water damage

- Clogged pipes

- Poor installation

Work with your Tennessee independent insurance agent to get all the sewer backup coverage you need with your home insurance in case of any of these incidents.

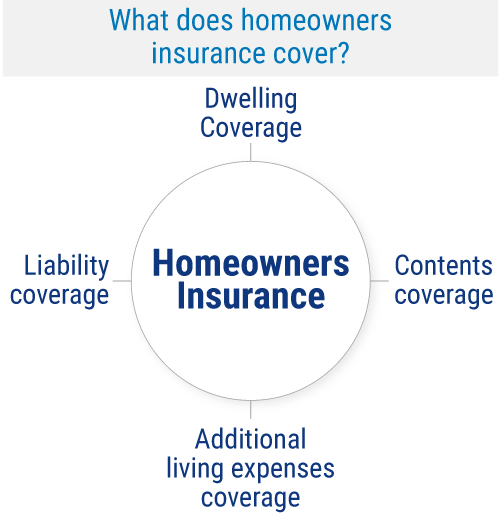

What Does Homeowners Insurance Cover in Tennessee?

Homeowners insurance in Tennessee provides a lot of important coverage for many elements of your home and its surroundings, like:

- Liability protection: Protects homeowners against lawsuit costs if a third party sues them for claims of property damage or bodily injury.

- Dwelling coverage: Protects homeowners from property damage to their home's structure caused by many threats like fire, falling objects, etc.

- Contents coverage: Protects homeowners from property damage to their belongings like electronics, clothing, and more from similar covered causes like fire, theft, etc.

- Additional living expenses: Protects homeowners from unexpected costs that can arise if they need to live somewhere else, like a hotel, while their home is being repaired after a covered disaster.

A Tennessee independent insurance agent will ensure that you get equipped with all the coverage you need by a homeowners insurance policy.

Why Choose a Tennessee Independent Insurance Agent?

It’s simple. Tennessee independent insurance agents simplify the process by shopping and comparing insurance quotes for you. Not only that, but they’ll also cut the jargon and clarify the fine print so you know exactly what you’re getting.

Tennessee independent insurance agents also have access to multiple insurance companies, ultimately finding you the best homeowners insurance coverage, accessibility, and competitive pricing while working for you.

Author | Chris Lacagnina

sewerpros.com/when-is-the-city-responsible-for-sewer-line/

trusteyman.com/blog/when-is-the-city-responsible-for-sewer-lines/#:~:text=When%20Is%20City%20Responsible%3F,the%20boundaries%20of%20your%20property.

© 2024, Consumer Agent Portal, LLC. All rights reserved.