In Tennessee, there are many farms, and coverage for them is essential to be fully protected. If you're in the business of selling products from your farm, you'll want coverage that lasts. Your Tennessee business insurance may include a crop-hail policy.

Fortunately, a Tennessee independent insurance agent can help with coverage and premium options that fit your budget. They work with several carriers so that you have choices. Get connected with a local expert for quotes.

What Is Crop-Hail Insurance?

Insuring your farm is one thing, but your crops are another. Your crop insurance policy is typically separate from your overall farm coverage but can sometimes be included on your primary policy, depending on your carrier. It protects your crops from some of the most destructive storms.

What Does Crop-Hail Insurance Cover in Tennessee?

When it comes to insuring your crops, you should have a pretty good idea of what goes into it by now. But what you need to know is what the policy will actually cover.

What your crop insurance generally covers:

Crop-hail coverage is popular with many farmers because hail can destroy a significant part of a planted field while leaving the rest undamaged. You may find yourself purchasing a crop-hail policy, which is necessary in most parts of the US to protect high-yielding crops. Unlike other crop insurance, a crop-hail policy can be purchased at any time during the growing season and will protect your crops against hail damage.

What Crop-Hail Insurance Doesn't Cover in Tennessee

While it's good to know what is covered, it's equally important to be aware of what's not included in your crop- hail policy. Take a look at some standard exclusions when it comes to your coverage:

- Flooding: Not all flooding is covered by crop insurance, so knowing your policy offerings is imperative.

- 20% of your crop value: There can be a type of coinsurance on a crop insurance policy where you'd owe the first 20% of the claim. The insurance company would cut you a check for the remaining 80%.

How Does Crop-Hail Insurance Work in Tennessee?

Whether you have a modest few acres of wheat or are the leading cotton producer in Tennessee, your coverage must apply adequately. When you own a farm, the proper protection is essential to avoid a major loss.

Your independent insurance agent will need to know the following to get started:

- Your crop specifications: What are your crops, where will you be storing them, how much is there, and how many acres will your crops be occupying?

- What your crops are worth: How much will it cost to replace your crops before, during, and after the final completion of your product.

- What preemptive protection you have in place: Are there special measures you take to ensure that your crops are safe from pests, wild animals, and predators? Are you using pesticides? What equipment are you using to care for your crops? Where are you storing your crops after growing and before distributing them?

Does Crop-Hail Insurance Cover Disasters in Tennessee?

You will want to be sure you have coverage for your seeds before putting them in the tilled soil. During their care and growth, you'll need coverage to protect against the elements and predators. And you'll also need protection after your Tennessee harvest, when you're storing your crops before they hit distribution. You may even need coverage for your crops while they are in transit to the buyer.

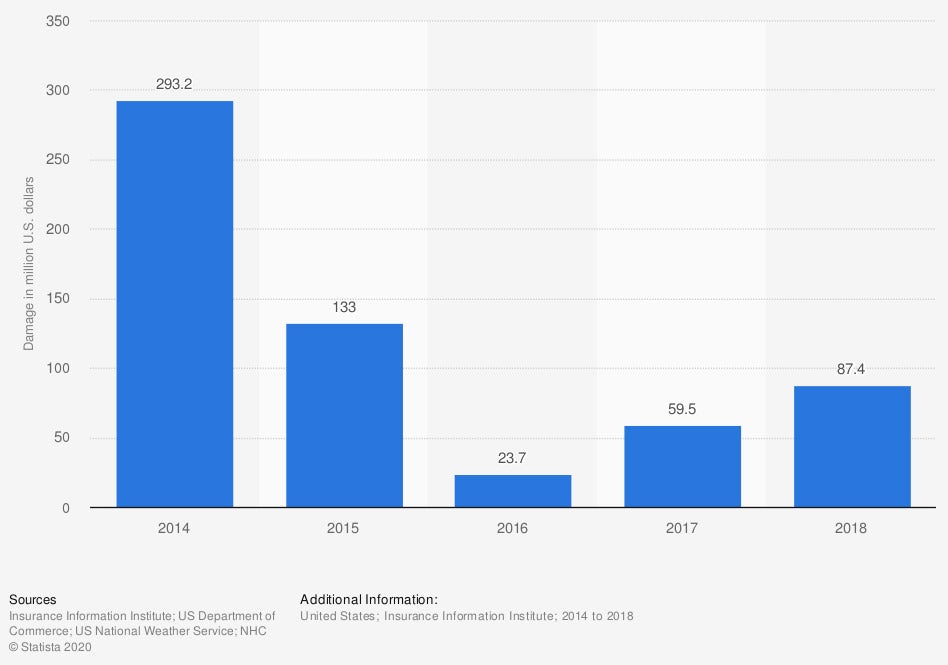

Crop hail damage in the US from 2014 to 2018 (in million US dollars)

Damage to crops can arise just from hail in a short period. It's best to have coverage in place for protection against perils before it's too late. There are also two main ways to obtain crop insurance. One is the private companies that your independent insurance agent works with. The other is the Federal Crop Insurance Corporation (FCIC).

The Best Crop Insurance Companies

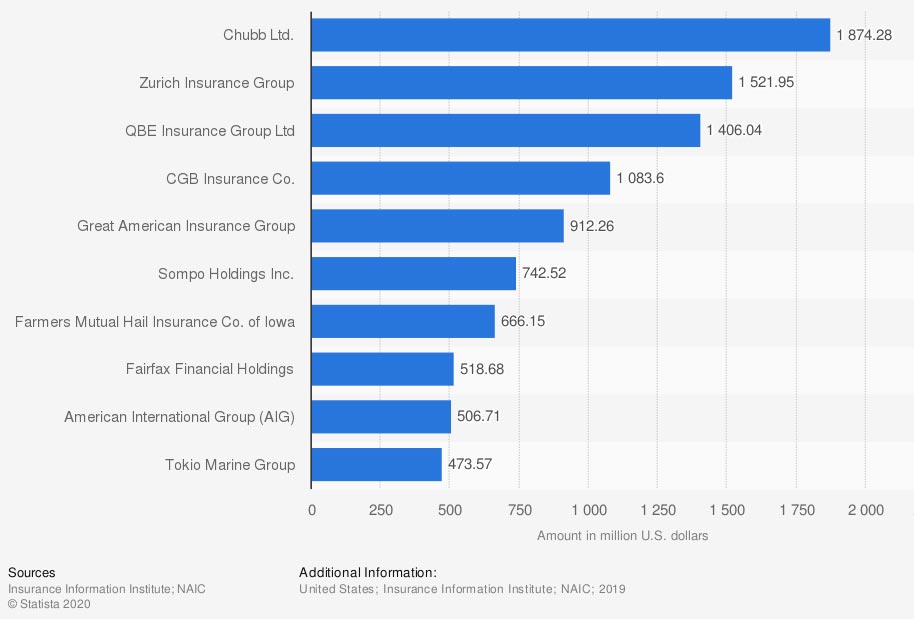

The best is relative to what coverages your Tennessee farm specifically needs for your crop insurance. It's good to understand what's out there in terms of who holds the largest market share. Take a look at the graph below for multiple peril crop insurance companies in the US:

2019 US crop insurance premiums by carrier

When you're ready to start comparing companies, you'll want to work with the best. There are several carriers that can provide coverage for your Tennessee farm.

How an Independent Insurance Agent Can Help in Tennessee

When looking for farm protection that fits your lifestyle and budget, consider working with a local adviser. Your business will need many policies, and it can be confusing when you're not a licensed professional. Crop-hail insurance is one coverage you'll want to have.

Fortunately, a Tennessee independent insurance agent can help with access to several markets. Since they quote with a network of carriers, you'll always have policy and premium options. Connect with an expert on TrustedChoice in minutes.

Article Author | Candace Jenkins

Graphic #1: https://www.statista.com/statistics/1015612/crop-hail-damage-usa/

Graphic #2: https://www.statista.com/statistics/689397/largest-mpci-companies-usa-by-direct-premiums/

http://www.city-data.com/city/Tennessee.html

© 2024, Consumer Agent Portal, LLC. All rights reserved.